Deciding whether to get pet insurance can be tricky, especially when trying to understand the costs involved; therefore, “How Much Does Lemonade Pet Insurance Cost” is a common question. At PETS.EDU.VN, we’re here to simplify it for you, focusing on Lemonade pet insurance, known for its user-friendly approach to pet health coverage. This guide will break down Lemonade’s pet insurance expenses and variables, helping you make an educated choice to protect your pet’s health and your wallet, emphasizing the affordability and extensive coverage offered by Lemonade. We’ll cover everything from average monthly costs to factors influencing premiums and ways to save, while also touching upon preventive care and policy add-ons, as well as potential savings, ensuring a complete understanding of pet healthcare and peace of mind through Lemonade pet insurance plans.

1. Understanding the Average Cost of Lemonade Pet Insurance

The cost of pet insurance isn’t fixed; it varies based on numerous factors. To give you a clearer picture, let’s look at what you might expect to pay for Lemonade pet insurance for both dogs and cats, noting the influence of pet insurance rates and veterinary costs.

1.1. Pet Insurance Costs for Dogs

When it comes to insuring your canine companion, several elements can influence the monthly premium. According to Lemonade’s data, pet parents spend around $47/month to cover their dogs, across different breeds, ages, and locations. Here’s a more detailed example, referencing the average cost of veterinary care and the benefits of pet insurance coverage:

For a 4-year-old Golden Retriever in Chicago, with a plan including 80% co-insurance, the maximum annual limit, and a $250 annual deductible, you might pay around $77 per month.

The table shows how Lemonade compares to other providers for the same coverage scenario:

| Insurance Provider | Average Monthly Cost |

|---|---|

| Figo | $92 |

| Nationwide | $86 |

| Trupanion | $330 |

| Embrace | $130 |

| Healthy Paws | $109 |

| Lemonade | $77 |

This comparison illustrates that Lemonade offers competitive rates, especially considering the comprehensive coverage they provide, demonstrating cost-effective pet healthcare options.

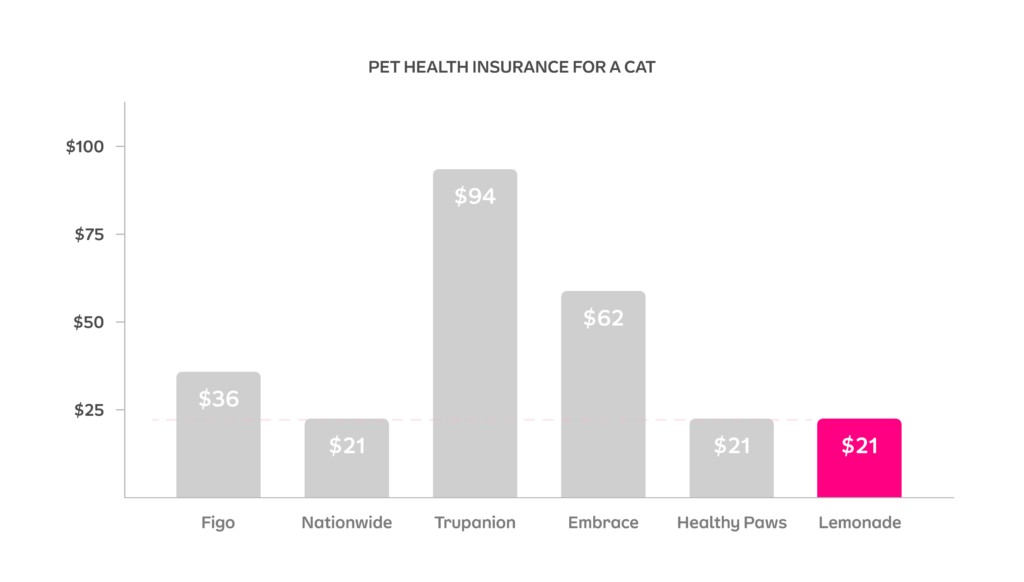

1.2. Pet Insurance Costs for Cats

Cats generally have lower insurance premiums than dogs, primarily because their medical expenses are typically lower. Lemonade’s average for cats is around $28 per month, considering various ages, breeds, and locations. Here’s an example illustrating the cost-saving potential of pet insurance, alongside the increasing popularity of Lemonade’s pet plans:

For a 2-year-old short-haired cat in Brooklyn, New York, a policy with a $250 deductible, 80% co-insurance, and the maximum annual limit would cost about $21 per month.

If we look at a 5-year-old short-haired cat in New York City, the average premium is about $67 per month, with the same co-insurance, annual limit, and deductible terms.

The breakdown below shows the average monthly costs from different providers for insuring a cat:

| Insurance Provider | Average Monthly Cost |

|---|---|

| Figo | $36 |

| Nationwide | $21 |

| Trupanion | $94 |

| Embrace | $62 |

| Healthy Paws | $21 |

| Lemonade | $21 |

As you can see, Lemonade stands out as one of the most affordable options for insuring your feline friend.

2. Factors Influencing the Cost of Lemonade Pet Insurance

Several elements come into play when determining the final quote for your pet insurance policy. Understanding these can help you customize your coverage to fit your budget and your pet’s needs.

2.1. Species: Cat vs. Dog

The type of pet you’re insuring plays a significant role in determining the premium. Here’s a clearer view of how different factors, including pet type, influence costs, underscoring the importance of pet insurance comparison for budget-conscious owners:

Dogs: Generally, insuring dogs is more expensive than insuring cats. Dogs are more prone to hereditary conditions and tend to be more active, increasing the risk of accidents and injuries. Breeds like German Shepherds and Labrador Retrievers are predisposed to conditions like hip dysplasia, which can be costly to treat.

Cats: Cats typically have fewer health problems than dogs and often live longer. Indoor cats are particularly less exposed to potential accidents or illnesses compared to dogs that frequently go outside.

2.2. Age of Your Pet

As pets age, the likelihood of health issues increases, influencing pet insurance rates. Here’s how age affects pet insurance expenses, encouraging early enrollment in pet health plans to secure lower premiums:

Young Pets: Insuring pets when they are young can be more affordable. Young animals are generally healthier and less likely to have pre-existing conditions, which aren’t covered by insurance.

Older Pets: Older pets are more likely to develop chronic conditions such as arthritis, diabetes, or heart disease. The older your pet is when you enroll them in a pet insurance plan, the higher the monthly premium is likely to be.

2.3. Breed-Specific Considerations

Certain breeds are predisposed to specific health conditions, which can impact pet insurance costs. This section details how breed-specific health issues affect pet insurance premiums, suggesting early coverage to mitigate future healthcare costs:

High-Risk Breeds: Breeds known for hereditary conditions, such as Bulldogs (respiratory issues) or Maine Coons (hypertrophic cardiomyopathy), may have higher premiums due to the increased likelihood of expensive vet visits.

Lower-Risk Breeds: Mixed-breed animals and breeds with fewer known health issues may have lower premiums because they are generally healthier and require less veterinary care.

2.4. Geographic Location

Veterinary costs vary significantly from state to state, affecting pet insurance rates. Here’s how regional differences in veterinary care costs affect insurance premiums, advocating for comprehensive coverage despite varying rates:

High-Cost Areas: States like California and New York have higher costs of living and, consequently, higher veterinary costs. Insuring your pet in these areas will likely result in higher premiums.

Low-Cost Areas: States with lower costs of living, such as Tennessee or Mississippi, typically have lower veterinary costs, which can translate to lower pet insurance premiums.

3. Saving Money on Lemonade Pet Insurance

While it’s crucial to have comprehensive coverage, there are ways to reduce your monthly premium without sacrificing essential protection.

3.1. Adjusting Co-Insurance

Co-insurance affects how much you pay out-of-pocket versus what the insurance company covers. Understanding co-insurance options can help lower monthly payments while maintaining adequate coverage:

Higher Co-Insurance: Choosing a higher co-insurance, such as 70%, means you pay a larger percentage of the bill, but your monthly premium will be lower.

Lower Co-Insurance: A lower co-insurance, like 90%, means the insurance company covers more of the costs, but your monthly premium will be higher.

3.2. Modifying Deductibles

The deductible is the amount you pay out-of-pocket before the insurance kicks in. Strategically selecting a deductible can balance monthly costs with potential out-of-pocket expenses:

Higher Deductible: Selecting a higher deductible ($500 or $750) will lower your monthly premium. This option is best if you can afford to pay more out-of-pocket if your pet needs expensive treatment.

Lower Deductible: Opting for a lower deductible ($100 or $250) will increase your monthly premium but reduce your out-of-pocket expenses when you file a claim.

3.3. Altering Annual Limits

Annual limits cap the total amount the insurance company will pay out in a year. Adjusting this limit can significantly impact your premium. Here’s how setting annual coverage limits can balance affordability with comprehensive veterinary care:

Lower Annual Limit: Choosing a lower annual limit, like $5,000, will decrease your monthly premium. However, be aware that you will be responsible for any costs exceeding this limit.

Higher Annual Limit: Selecting a higher annual limit, such as $100,000, will increase your monthly premium but provide more comprehensive coverage for expensive treatments.

4. Lemonade Pet Insurance Claims: How They Work

Understanding the claims process can make using your pet insurance much easier. The following simplifies the claims process with Lemonade, providing examples of how co-insurance and deductibles affect reimbursements:

- Vet Visit: Take your pet to any licensed vet in the U.S.

- Pay Upfront: Pay the vet bill and obtain a detailed invoice.

- Submit Claim: Use the Lemonade mobile app to submit your claim by uploading the invoice.

- Review: Lemonade’s claims team reviews your claim to ensure the situation is covered under your policy.

- Reimbursement: You’ll be reimbursed for the eligible amount based on your policy’s co-insurance, deductible, and annual limit.

4.1. Claims Calculation Example

Here’s an example of how the claims payment would be calculated:

Your dog, Mogley, needs knee surgery. The procedure costs $6,000, and your policy includes 80% co-insurance and a $250 deductible.

($6,000 x 80%) – $250 = $4,550

In this case, Lemonade would pay $4,550 towards the claim, and you would be responsible for the remaining $1,450 (including the deductible).

5. Maximizing Coverage with Lemonade Add-Ons

Lemonade offers several add-ons to customize your pet insurance policy further. Exploring these add-ons can enhance coverage for routine and specialized care, ensuring comprehensive protection:

5.1 Preventative Care Packages

Lemonade offers optional preventative care plans to cover routine health needs, including:

- Basic Preventative Package: Covers annual wellness exams, heartworm or FeLV/FIV tests, up to three vaccines, a parasite or fecal test, and a blood test.

- Preventative+ Package: Includes everything in the Basic package, plus routine dental cleaning and heartworm medication.

- Puppy/Kitten Preventative Package: Designed for pets under two years old, covering spaying/neutering, microchipping, and heartworm and flea medication.

5.2 Additional Add-Ons

Lemonade provides five optional add-ons to further customize your policy:

- Vet Visit Fees: Covers fees charged by vets for their time and labor after an accident or illness.

- Physical Therapy: Covers physical therapy, acupuncture, and hydrotherapy to aid your pet’s recovery.

- Dental Illness: Covers procedures like tooth extractions and root canals, as well as treatments for gingivitis and periodontal disease.

- Behavioral Conditions: Covers vet-recommended therapy and medications for behavioral conditions like anxiety and aggression.

- End of Life and Remembrance: Covers vet-recommended euthanasia, cremation, and commemorative items.

6. What Lemonade Pet Insurance Does Not Cover

Knowing what’s not covered is as important as understanding what is. Here’s a look at standard exclusions in Lemonade’s pet insurance policies, advising careful review of policy terms to avoid surprises:

- Pre-Existing Conditions: Any condition that showed up in your pet’s medical history before your policy was active or during the waiting period.

- Preventable Situations and Neglect: Health issues resulting from a pet parent’s failure to provide a safe environment or reasonable preventative care.

- Certain Non-Medical Procedures: Grooming, elective cosmetic procedures, obedience training, and boarding or travel costs.

7. Real Savings with Lemonade: Is Pet Insurance Worth It?

Deciding whether pet insurance is a worthwhile investment involves weighing the costs against potential savings. Here are several benefits to consider:

- Financial Security: Pet insurance helps you avoid difficult financial decisions when unexpected veterinary costs arise.

- Comprehensive Coverage: A standard policy covers diagnostics, procedures, and medications for eligible accidents and illnesses.

- Peace of Mind: Knowing you can afford necessary treatments ensures your pet’s health without straining your finances.

By providing examples of savings and coverage, you can decide whether pet insurance fits your financial situation and your pet’s needs.

8. Lemonade Pet Insurance: Accessibility and Availability

Lemonade is committed to providing pet insurance in as many states as possible. The following provides a clear list of states where Lemonade currently offers pet health insurance, making it easy for pet owners to check availability:

Lemonade currently offers pet health insurance in the following states: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, Iowa, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Washington, D.C. (not a state… yet), and Wisconsin.

9. Frequently Asked Questions (FAQs) About Lemonade Pet Insurance

9.1. How Much Should I Be Spending on Pet Insurance?

Deciding how much to spend on pet insurance involves balancing your pet’s needs with your financial readiness. Assessing potential needs and financial constraints ensures a balanced approach to selecting pet insurance:

Consider what your pet may need and what you’re ready to pay. Adjust your coverage options to find a balance between cost and coverage.

9.2. How Much of My Vet Bills Does Pet Insurance Cover?

The extent of coverage depends on your chosen co-insurance. Here’s a simple explanation:

Typically, policyholders opt for 80% co-insurance, meaning the insurance covers 80% of eligible medical expenses, and you’re responsible for the remaining 20%.

9.3. Does the Cost of Pet Insurance Increase as My Pet Ages?

Yes, the cost of pet insurance typically increases as your pet ages. The reasons are:

Older pets are more prone to health issues and chronic conditions, which can lead to higher veterinary costs.

9.4. Is Pet Insurance Worth It?

Pet insurance can cover your furry friend for a number of unexpected accidents and illnesses, offering you and your wallet some serious peace of mind. However, it’s important to note the limitations:

Consider whether you’d be able to cover the out-of-pocket costs needed to protect your pet in the event of a medical emergency.

9.5. What Vets are Accepted by Lemonade Pet Insurance?

Lemonade Pet works on a reimbursement basis, so you can take your pet to any licensed vet in the U.S. Here’s how it works:

You pay the vet bill upfront and submit the receipts to Lemonade for reimbursement.

9.6. How Can Pet Insurance Reduce My Vet Costs?

Pet insurance helps cover the costs of diagnostics, procedures, and medications to treat your pet’s eligible accidents and illnesses. The benefits are:

- Diagnostics: Blood tests, x-rays, MRI’s, CT scans, and lab work.

- Procedures: Outpatient, specialty and emergency care, hospitalization and surgery.

- Medication: Injections or prescription meds.

9.7. Are There Discounts Available for Multiple Pets?

Some insurance companies offer discounts for insuring multiple pets.

Check with Lemonade to see if they offer a multi-pet discount.

9.8. Can I Change My Coverage Options After Enrolling?

In most states, you can request coverage downgrades, such as increasing your deductible or decreasing your co-insurance, at any time during the policy period. Be mindful of limitations:

Not available in New Hampshire or California.

9.9. What Is a Waiting Period?

A waiting period is the time between when you purchase your policy and when coverage begins. This section explains the purpose and duration of waiting periods in pet insurance policies:

Lemonade, like most pet insurance companies, has a waiting period before your coverage becomes effective.

9.10. Does Lemonade Cover Pre-Existing Conditions?

Pet insurance typically doesn’t cover pre-existing conditions. Make sure you know:

Anything that shows up in your pet’s medical history from before your policy was active won’t be covered.

At PETS.EDU.VN, we understand that navigating pet insurance can be overwhelming. That’s why we’ve broken down the essentials of Lemonade pet insurance costs, coverage, and ways to save, ensuring you can make an informed decision to protect your beloved pet.

Choosing the right pet insurance is a crucial step in ensuring your pet’s health and your financial well-being. We encourage you to visit PETS.EDU.VN for more detailed information and to explore additional resources tailored to your pet’s specific needs. Our site offers comprehensive guides, expert advice, and tools to help you navigate the complexities of pet care.

Ready to learn more and find the perfect pet insurance plan?

- Explore detailed articles on various pet health topics.

- Get personalized recommendations based on your pet’s breed, age, and health history.

- Connect with a community of pet owners and experts.

Visit PETS.EDU.VN today and take the next step in providing the best care for your furry friend!

If you have more questions or need personalized assistance, please contact us:

- Address: 789 Paw Lane, Petville, CA 91234, United States

- WhatsApp: +1 555-987-6543

- Website: pets.edu.vn

We’re here to help you every step of the way, ensuring your pet receives the best possible care without breaking the bank.