Peter Thiel, the co-founder of PayPal and Palantir Technologies, is a figure synonymous with Silicon Valley innovation and libertarian ideals. He is known for his contrarian thinking, his early bet on Facebook, and his vocal critiques of government overreach, particularly when it comes to taxation. Thiel has publicly criticized “confiscatory taxes” and supported initiatives promoting tax havens. However, the reality of his own tax strategy, revealed through confidential IRS data, is a masterclass in leveraging legal loopholes to minimize tax obligations and exponentially grow his wealth. This investigation delves into the staggering Net Worth Of Peter Thiel, focusing on how a seemingly ordinary retirement account transformed into a multi-billion dollar, tax-exempt empire, significantly contributing to his overall fortune.

While estimations of Peter Thiel’s net worth often place him in the billions, public figures and financial analysts have consistently underestimated the true scale of his wealth. A key component of his financial strategy, and a significant contributor to his burgeoning net worth, is his Roth Individual Retirement Account (IRA). Originally designed as a savings vehicle for middle-class Americans, Thiel has utilized the Roth IRA to an extraordinary extent, turning it into a tax-free piggy bank of unprecedented proportions. IRS data reveals that Thiel transformed an initial Roth IRA investment of less than $2,000 in 1999 into a colossal $5 billion windfall within two decades. This article explores how Thiel achieved this remarkable feat, examining the controversial tactics employed and the broader implications for tax fairness and wealth accumulation in America.

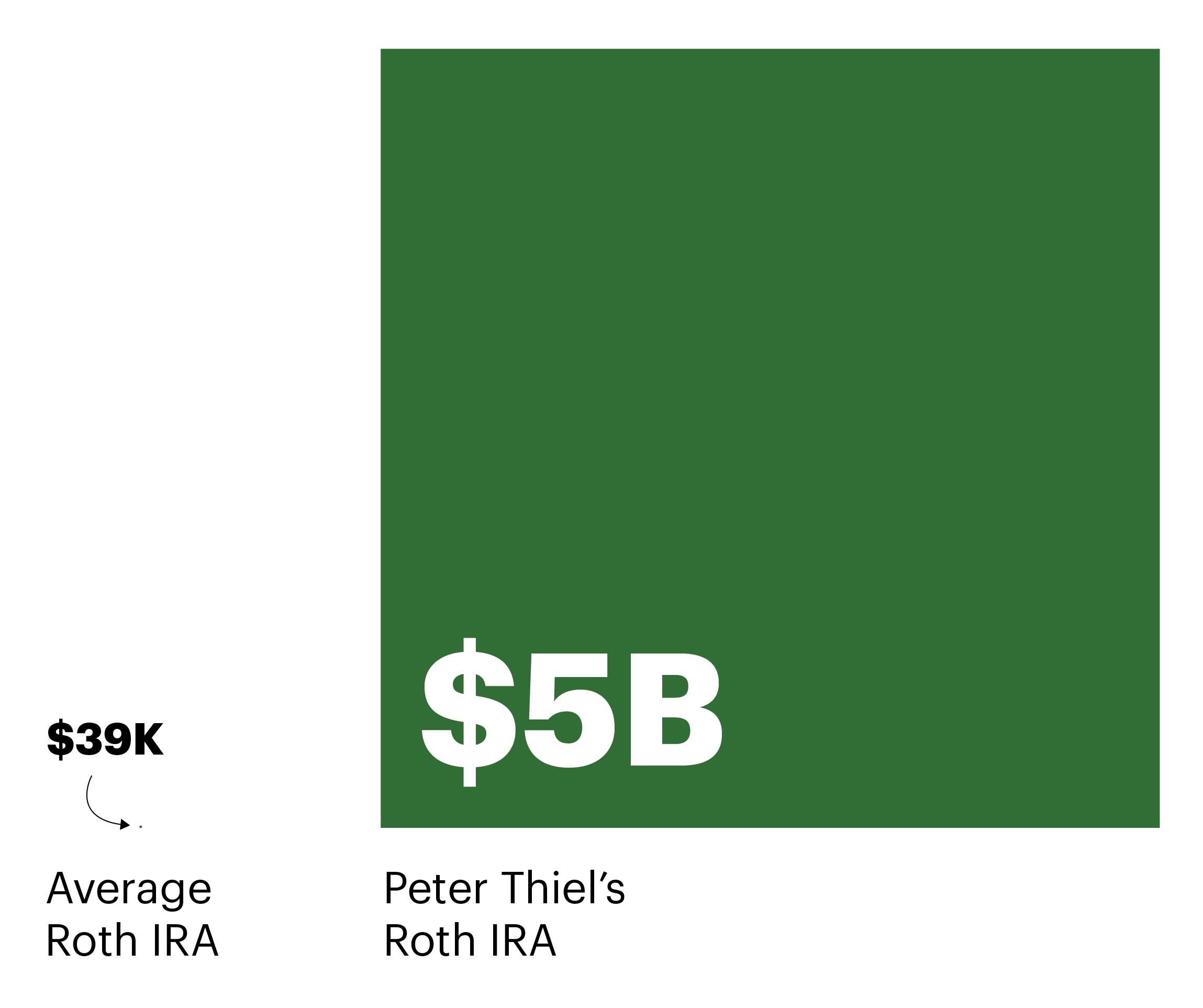

To truly grasp the magnitude of Thiel’s Roth IRA and its impact on his net worth, consider this comparison: the average Roth IRA in 2018 was valued at approximately $39,108. Thiel’s Roth IRA dwarfs this figure by orders of magnitude. In fact, the $5 billion contained within his Roth IRA exceeds the combined savings of millions of average Americans. This raises critical questions about the equitable application of tax laws and whether systems intended for the middle class are being exploited to further enrich the ultra-wealthy, like Peter Thiel, and inflate their already substantial net worth.

ProPublica’s investigation, based on a vast trove of leaked IRS tax return data covering over 15 years from thousands of the wealthiest Americans, provides an unprecedented glimpse into the financial lives of the top 0.001%. This data exposes a stark reality: while ordinary Americans diligently contribute their share to the nation’s tax revenue, the wealthiest individuals are adeptly navigating and, at times, circumventing the tax system. Peter Thiel’s Roth IRA is a prime example of this trend, showcasing how legal, yet ethically questionable, strategies can dramatically augment the net worth of the ultra-rich while potentially depriving the government of significant tax revenue.

One of the most striking revelations from the IRS files is the extent to which Roth IRAs, with their seemingly modest annual contribution limits, have become instruments of immense wealth accumulation for a select few. The Roth IRA, conceived by the late Senator William Roth Jr., was intended to encourage retirement savings for “hard-working, middle-class Americans.” However, the original regulations, designed to prevent wealthy individuals from exploiting the system, contained loopholes that entrepreneurs like Thiel were quick to identify and capitalize on, dramatically increasing their net worth over time.

The strategy employed by Thiel and others involved a calculated maneuver: initiating a Roth IRA with a minimal investment – often less than the annual contribution limit – and then leveraging it to acquire stakes in promising startup companies at deeply discounted valuations. This approach, combined with the subsequent exponential growth of these startups, particularly in the tech sector, allowed for tax-free accumulation of wealth on a scale unimaginable to the average Roth IRA holder. The gains generated within the Roth IRA, no matter how astronomical, are shielded from taxation upon withdrawal in retirement, provided certain conditions are met. This tax-free growth engine has become a powerful tool for magnifying the net worth of individuals with access to early-stage investment opportunities, like Peter Thiel.

Further amplifying the potential of Roth IRAs as wealth-building vehicles, Congress enacted changes roughly a decade after their inception that broadened their accessibility and tax advantages. The introduction of Roth conversions allowed individuals, regardless of income level, to transfer funds from traditional retirement accounts into Roth IRAs by paying a one-time income tax on the converted amount. This legislative amendment effectively transformed Roth IRAs into even more potent tax shelters, enabling the wealthiest Americans to shield vast fortunes from future taxation, further solidifying and expanding their net worth. This created what some experts have termed a “Bermuda-style tax haven” within the U.S. retirement system, disproportionately benefiting those already at the apex of the wealth spectrum.

From Humble Beginnings to Billions: The Roth IRA Ascent of Peter Thiel

To uncover the extent of Roth IRA wealth accumulation among the ultra-rich, ProPublica meticulously examined tax return data, focusing on accounts exceeding $20 million in value. This investigation, supplemented by reviews of SEC filings, court documents, and other records, including a memo detailing Thiel’s wealth as part of his New Zealand residency application, revealed a startling trend. For a select group of individuals, the “individual retirement account” had become a misnomer, evolving from a modest retirement nest egg into a turbo-charged investment vehicle, subsidized by American taxpayers and significantly bolstering their overall net worth.

Beyond Thiel, the investigation identified other prominent figures who have amassed substantial Roth IRA fortunes. Ted Weschler, a key investment manager at Berkshire Hathaway under Warren Buffett, held $264.4 million in his Roth IRA at the end of 2018. Randall Smith, a hedge fund manager known for Alden Global Capital’s acquisition and restructuring of newspapers, possessed $252.6 million in his Roth. Even Warren Buffett himself, despite advocating for higher taxes on the wealthy, had a Roth IRA valued at $20.2 million. Robert Mercer, a former hedge fund manager at Renaissance Technologies, held $31.5 million in his Roth. These examples underscore the widespread, albeit less publicized, utilization of Roth IRAs as potent wealth accumulation tools by the financial elite, contributing significantly to their individual net worth.

While these figures pale in comparison to Thiel’s multi-billion dollar Roth IRA, they highlight a systemic issue: the Roth IRA, intended for middle-class retirement security, has become a playground for the ultra-wealthy to legally minimize taxes and maximize their wealth. The sheer scale of Thiel’s Roth IRA, however, remains unparalleled, serving as a stark illustration of the potential for wealth accumulation within these tax-advantaged accounts and its dramatic impact on an individual’s net worth.

Despite the growing awareness of mega-Roth IRAs, and the potential tax revenue losses associated with them, legislative reforms have been limited. The Government Accountability Office (GAO), the investigative arm of Congress, has repeatedly cautioned about the unintended consequences of Roth IRA regulations, highlighting how the wealthiest Americans were accumulating vast retirement accounts in ways that lawmakers never envisioned. Simultaneously, budget cuts have severely hampered the IRS’s ability to effectively audit and address potential abuses within the system. This combination of legislative inaction and weakened enforcement has created an environment conducive to the continued growth of mega-Roth IRAs and the further enrichment of the ultra-wealthy, like Peter Thiel, contributing to the expansion of their net worth.

Senator Ron Wyden, an Oregon Democrat, attempted to introduce reforms in 2016 aimed at curbing the tax advantages of mega-Roth IRAs, stating that “Tax incentives for retirement savings are designed to help people build a nest egg, not a golden egg.” His proposal, which would have required Roth IRA owners with balances exceeding $5 million to take mandatory distributions, faced strong opposition and ultimately failed to gain traction in the Republican-controlled Senate. This legislative gridlock has allowed individuals like Thiel to continue benefiting from the existing system, with their Roth IRAs and overall net worth continuing to swell unchecked.

And indeed, Thiel’s Roth IRA continued its exponential growth. By the end of 2019, it reached the staggering $5 billion mark, increasing by over $3 billion in just three years. This phenomenal growth, entirely tax-free, underscores the immense wealth-building power of Roth IRAs when strategically utilized, and its substantial contribution to Peter Thiel’s overall net worth.

Thiel, a known admirer of J.R.R. Tolkien, even brought his Roth IRA under the umbrella of a family trust company named Rivendell Trust, evoking the hidden elven sanctuary from “The Lord of the Rings.” This further emphasizes the sense of protection and isolation surrounding his vast, tax-sheltered fortune, a fortune that significantly exceeds publicly reported estimates of his net worth. In 2019, Forbes estimated Thiel’s total net worth at $2.3 billion – less than half the value of his Roth IRA alone, highlighting the underestimation of his actual wealth due to the hidden nature of these tax-advantaged accounts.

The Mechanics of a Mega-Roth: How Thiel Built His Tax-Free Empire

To illustrate the extraordinary transformation of Thiel’s Roth IRA, consider the step-by-step process that turned a modest initial investment into a multi-billion dollar fortune, significantly impacting his overall net worth.

It began with a seemingly small contribution: Thiel deposited approximately $2,000 into a Roth IRA in 1999.

Crucially, Thiel, unlike most Roth IRA holders, then utilized these funds to acquire 1.7 million shares in his nascent startup, PayPal, at an incredibly low price of $0.001 per share. This access to pre-IPO stock at a minuscule valuation was a key advantage unavailable to the vast majority of investors.

Years later, PayPal experienced explosive growth and was acquired by eBay. The value of Thiel’s shares, held within his Roth IRA, skyrocketed.

As a result, Thiel’s initial $2,000 investment within the Roth IRA rapidly appreciated to $50 million, entirely shielded from taxation.

Ordinarily, selling these shares outside a Roth IRA would trigger a substantial capital gains tax liability. However, because the shares were held within the Roth, Thiel incurred no tax obligations whatsoever on these massive gains.

Thiel then strategically reinvested the $50 million proceeds, still within the tax-advantaged Roth IRA, into other promising ventures, including Palantir Technologies and Facebook.

These subsequent investments, particularly his early stake in Facebook, further amplified the growth of his Roth IRA, generating billions of dollars in additional tax-free gains.

The fundamental principle of the Roth IRA – tax-free growth and tax-free withdrawals in retirement – combined with Thiel’s access to undervalued startup shares, created a perfect storm for wealth accumulation on an unprecedented scale. This strategy transformed a retirement savings vehicle intended for the middle class into a personal tax-free investment bank for Peter Thiel, dramatically augmenting his net worth.

This exploitation of the Roth IRA mechanism becomes particularly concerning when juxtaposed with the retirement realities of many Americans. A significant portion of the U.S. working population has little to no retirement savings, highlighting the widening gap between the ultra-wealthy, who are adept at leveraging tax-advantaged accounts, and the average American struggling to secure their financial future. This disparity underscores the potential for tax policies, even those designed with good intentions, to exacerbate wealth inequality and further concentrate wealth in the hands of a select few, like Peter Thiel, contributing to the ever-increasing gap in net worth.

The Roth IRA emerged in the 1990s amidst concerns about declining savings rates and the inadequacy of traditional retirement plans. Senator Roth’s vision was to create a savings vehicle that would incentivize Americans to save for retirement. However, the Roth IRA, in practice, has become a dual-edged sword. While it may benefit some middle-class savers, it has also been strategically weaponized by the ultra-wealthy to accumulate vast fortunes tax-free, further widening the wealth gap and significantly contributing to the net worth of individuals like Peter Thiel.

Senator Roth himself, a proponent of lower taxes and reduced government spending, may have inadvertently created a tax loophole that has disproportionately benefited the ultra-wealthy. The Clinton administration’s initial attempts to limit Roth IRA access for high-income earners proved insufficient to prevent individuals like Thiel from exploiting the system to amass tax-free fortunes and dramatically increase their net worth.

In early 1999, a pivotal meeting at Pensco Pension Services in San Francisco marked the beginning of Thiel’s Roth IRA journey. Tom Anderson, Pensco’s founder, recalled advising Thiel and other PayPal executives to consider the Roth IRA for their startup shares, emphasizing the potential for tax-free growth. Thiel, recognizing the immense potential of PayPal, grasped the tax advantages of the Roth IRA and proceeded to purchase founders’ shares within the account.

At the time, Thiel’s income was below the Roth IRA contribution limit, making him eligible to contribute. However, his access to founders’ shares in a high-growth startup, priced at a fraction of a penny per share, provided an unparalleled opportunity for wealth accumulation within the Roth, a benefit unavailable to typical Roth IRA contributors investing in publicly traded assets. This early access to undervalued equity was instrumental in setting the stage for the exponential growth of Thiel’s Roth IRA and its subsequent contribution to his net worth.

The valuation of these founders’ shares at the time of purchase has raised eyebrows among tax experts. Victor Fleischer, a tax law professor, described the purchase of startup shares at such a discounted price within a Roth IRA as “a huge scandal,” questioning the defensibility of such valuations and highlighting the potential for abuse in “stuffing” IRAs with undervalued assets to circumvent contribution limits and inflate net worth.

Warren Baker, a tax attorney specializing in IRAs, echoed these concerns, suggesting that purchasing founders’ shares in a startup with a Roth IRA carries significant risk of IRS scrutiny regarding valuation. The inherent difficulty in accurately valuing private company shares, particularly in early stages, creates opportunities for aggressive valuation practices that can further amplify the tax advantages of Roth IRAs and contribute to wealth accumulation for insiders like Thiel.

Despite the rapid influx of investment into PayPal shortly after Thiel’s share purchase, Pensco reported a modest valuation of $1,664 for Thiel’s Roth IRA at the end of 1999. This seemingly low valuation, despite the company’s promising trajectory, further fueled the subsequent exponential growth within the Roth, as the true market value of PayPal shares was likely significantly higher, creating a built-in gain that would accrue tax-free within Thiel’s account and contribute to his expanding net worth.

From this point forward, Thiel’s Roth IRA embarked on an extraordinary trajectory. In just one year, its value surged from $1,664 to $3.8 million – a staggering 227,490% increase. This meteoric rise underscores the transformative power of early-stage startup equity when held within a tax-advantaged Roth IRA, and its profound impact on the overall net worth of individuals with privileged access to such investment opportunities.

The 2002 acquisition of PayPal by eBay provided a further catalyst for Thiel’s Roth IRA growth. The sale of PayPal shares within the Roth generated a massive influx of tax-free proceeds, propelling the account’s value to $28.5 million by the end of that year. This event solidified the Roth IRA as a central pillar of Thiel’s wealth accumulation strategy, transforming it into a personal, tax-exempt investment vehicle capable of generating and compounding wealth on a scale rarely witnessed, significantly contributing to his burgeoning net worth.

Had Thiel held these PayPal shares outside of his Roth IRA, he would have faced substantial tax liabilities on the gains. However, the Roth IRA structure completely eliminated these taxes, saving him millions and providing him with a significant financial advantage. This tax-free capital became the fuel for further investments in other high-growth startups, including Palantir and Facebook, perpetuating a cycle of tax-advantaged wealth accumulation that has been instrumental in shaping Peter Thiel’s immense net worth.

Thiel’s strategic reinvestment of Roth IRA proceeds into Palantir and Facebook further cemented the account’s status as a tax-free wealth-building machine. His early investment in Facebook, in particular, proved to be exceptionally lucrative, adding billions to his Roth IRA value as Facebook’s valuation soared, and consequently, significantly boosting his overall net worth. This cycle of reinvesting tax-free gains into high-growth ventures has been a defining characteristic of Thiel’s Roth IRA strategy and a key driver of his immense wealth accumulation.

Despite benefiting immensely from these tax advantages, Thiel has publicly advocated for lower taxes and fiscal conservatism. His 2006 Forbes column, “Warning: Save, Save, Save,” urged Americans to prioritize saving and live modestly, while simultaneously leveraging a Roth IRA to accumulate billions tax-free. This apparent contradiction highlights the complex relationship between public pronouncements, personal financial strategies, and the ethical implications of utilizing tax loopholes to maximize personal wealth while advocating for broader fiscal austerity.

Thiel’s acquisition of New Zealand residency in 2005, facilitated in part by highlighting the value of his Roth IRA in his application, further underscores the global dimensions of wealth management and tax optimization for the ultra-rich. His Roth IRA, a U.S.-based tax-advantaged account, played a role in his international financial planning, demonstrating the interconnectedness of domestic and global wealth strategies employed by individuals with substantial net worth.

By 2008, Thiel’s Roth IRA had reached $870 million, a testament to the compounding power of tax-free growth and strategic early-stage investments. While other PayPal alumni also achieved substantial Roth IRA balances, Thiel’s remained in a league of its own, highlighting the exceptional success of his Roth IRA strategy and its outsized contribution to his overall net worth.

The subsequent legislative changes in 2010, allowing Roth conversions for high-income earners, further opened the floodgates for the ultra-wealthy to utilize Roth IRAs as mega-tax shelters. While Thiel had already amassed a significant Roth IRA fortune prior to these changes, the Roth conversion provision further legitimized and expanded the potential for Roth IRAs to become instruments of massive, tax-free wealth accumulation for the top 0.001%, further contributing to the concentration of wealth and potentially exacerbating wealth inequality.

Scrutiny, Audits, and Enduring Wealth

The revelation of Mitt Romney’s large traditional IRA during the 2012 presidential election brought increased public scrutiny to the issue of mega-sized retirement accounts. The subsequent GAO report in 2014 further highlighted the potential for abuse and the discrepancy between the intended purpose of IRAs and their actual utilization by the ultra-wealthy. While these reports and public discussions did not specifically name Thiel, they underscored the systemic issues that allowed for the creation of mega-Roth IRAs and the associated tax revenue losses, indirectly drawing attention to the strategies employed by individuals like Thiel to maximize their net worth through tax-advantaged accounts.

Despite the growing scrutiny, legislative reforms to curb mega-Roth IRAs have been largely unsuccessful. Proposals to limit the tax advantages of these accounts have faced strong opposition, and the IRS’s ability to effectively audit and enforce existing regulations remains constrained by budget limitations. This ongoing inaction has allowed the system to persist, enabling the continued accumulation of vast, tax-free wealth within Roth IRAs for a select few, and further contributing to the expansion of their net worth.

In 2009, Gawker Media first publicly revealed Thiel’s Facebook investment within a tax-free Roth IRA, bringing his specific case into the public discourse, albeit in a limited fashion. Subsequently, Thiel faced an IRS audit in 2011, although the specifics and outcome of the audit remain unclear. Despite this scrutiny, Thiel’s Roth IRA continued to grow, demonstrating the resilience of these wealth-building strategies even in the face of regulatory attention.

Throughout the lifespan of his Roth IRA, Thiel also generated substantial income outside of the account, further contributing to his overall net worth. However, his strategic utilization of the Roth IRA as a tax-free growth engine has undoubtedly been a central pillar of his wealth accumulation strategy, allowing him to compound his fortune at an accelerated pace and minimize his tax obligations, ultimately maximizing his net worth.

By 2019, Thiel’s Roth IRA holdings had become so vast and diversified that they were spread across 96 subaccounts, reaching a staggering $5 billion in value. This immense, tax-free fortune dwarfs publicly available estimates of his net worth and underscores the hidden wealth accumulation potential of Roth IRAs for the ultra-wealthy.

Thiel’s significant political contributions to anti-tax Republican groups and politicians further illustrate his commitment to minimizing taxation, both personally and at a broader policy level. His endorsement of Donald Trump in 2016, a relatively uncommon stance among Silicon Valley titans, aligns with his libertarian ideology and his consistent advocacy for lower taxes and reduced government regulation.

As Thiel’s wealth continued to grow, he transferred his Roth IRA to Rivendell Trust in 2018, further solidifying the sense of a protected, tax-sheltered financial sanctuary. His investments in anti-aging technology, some of which are held within his Roth IRA, reflect a long-term perspective on wealth preservation and accumulation, potentially spanning decades to come, with his Roth IRA continuing to compound tax-free and further enhance his net worth.

Assuming a modest 6% annual return, Thiel’s Roth IRA could potentially reach a staggering $263 billion by his hypothetical 120th birthday. This astronomical figure, exceeding the GDP of his adopted homeland New Zealand, underscores the almost limitless wealth accumulation potential of mega-Roth IRAs and the profound implications for wealth inequality and tax policy in the 21st century. Peter Thiel’s Roth IRA serves as a powerful case study in how existing tax laws can be strategically leveraged to create and protect vast fortunes, significantly contributing to the net worth of the ultra-wealthy while raising fundamental questions about tax fairness and the equitable distribution of wealth.

Help Us Report on Taxes and the Ultrawealthy

Do you have expertise in tax law, accounting or wealth management? Do you have tips to share? Get in touch with ProPublica.