Spot good pet insurance? Spot is a leading option in the pet insurance market, offering customizable plans and extensive coverage. PETS.EDU.VN takes a deep dive into Spot Pet Insurance, examining its plans, costs, coverage, and customer reviews to help you decide if it’s the right choice for your furry friend. Explore Spot pet insurance benefits and discover how Spot pet protection can safeguard your pet’s health.

1. Spot Pet Insurance: An Overview

Spot Pet Insurance stands out as a highly rated provider, securing the 6th position on our list of the top 10 best pet insurance options for 2024. It’s particularly noted for its customizable coverage. Operating across all 50 U.S. states and Washington, D.C., Spot has become a popular choice for pet owners seeking comprehensive protection. Our research indicates that the average Spot customer can anticipate spending approximately $51 monthly or $612 annually for their pet insurance coverage.

While Spot’s pricing exceeds the national average of $46 per month or $552 annually, the company provides a 10% discount for insuring multiple pets. According to our 2024 pet insurance survey, almost half of the respondents spent between $300 and $999 on their pet’s routine veterinary care in the past year. A Spot pet insurance plan could have provided significant savings.

Spot boasts numerous advantages, including coverage for behavioral issues and alternative treatments like acupuncture. However, its limitations include customer service only available on weekdays. Despite these drawbacks, Spot remains a strong contender, especially for pet owners who prioritize customizable coverage or those with older pets, given the absence of an upper age limit for enrollment. Looking for the best accident and illness coverage? PETS.EDU.VN can help you navigate the options.

2. Spot Pet Insurance Review: Ratings & Methodology

Our detailed pet insurance methodology awards Spot a score of 4.4 out of 5 stars. The company excels in coverage, covered treatments, and availability but loses points on cost.

The following table provides a detailed breakdown of Spot’s performance in our 2024 pet insurance study, alongside industry averages for comparison.

| Rating Category | Spot Pet Insurance Score | Industry Average |

|---|---|---|

| Cost and Discounts | 3.3 / 5 | 3.0 / 5 |

| Coverage | 5 / 5 | 4.2 / 5 |

| Covered Treatments | 4.8 / 5 | 4.0 / 5 |

| Customer Experience | 4.4 / 5 | 3.8 / 5 |

| Industry Standing | 4.5 / 5 | 4.0 / 5 |

| Availability | 5.0 / 5 | 4.5 / 5 |

3. Spot Pet Insurance: Pros and Cons

Spot Pet Insurance offers a range of benefits and drawbacks that pet owners should consider when deciding if it’s the right fit for their needs.

3.1. Advantages of Spot Pet Insurance

- Multiple Deductible Choices: Spot offers five annual deductible options, providing greater flexibility than many competitors.

- Affordable Accident-Only Coverage: Ideal for older or unhealthy pets, Spot provides budget-friendly accident-only plans.

- Extensive Coverage Limits: Spot offers a wide array of annual limit options, including an unlimited option, surpassing many other providers.

- No Age Restrictions: Unlike some insurers, Spot doesn’t impose age limits for enrollment or coverage.

- End-of-Life Coverage: Base plans cover end-of-life expenses if a pet passes away due to a covered condition.

3.2. Disadvantages of Spot Pet Insurance

- No Website Chat: Spot lacks a website chat feature, unlike some competitors.

- Limited Industry Experience: Established in 2019, Spot has fewer years of experience in the pet insurance industry.

- Longer Waiting Period: A 14-day waiting period for accidents is longer compared to some competitors.

4. Spot Pet Insurance Compared to Competitors

The following table compares Spot to other top pet insurance companies, focusing on monthly costs, star ratings, accident waiting periods, and Better Business Bureau (BBB) ratings:

| Company | BBB Rating | Monthly Cost | Star Rating | Accident Waiting Period |

|---|---|---|---|---|

| Spot Pet Insurance | A | $51-$68 | 4.6 | 14 days |

| Lemonade | N/R | $41-$52 | 4.4 | 2 days* |

| ASPCA Pet Health Insurance | N/R | $38-$50 | 4.5 | 14 days |

| Fetch Pet Insurance | A+ | $43-$50 | 4.4 | Up to 15 days |

| Embrace | A+ | $53-$64 | 4.6 | 2 days |

| Healthy Paws | A+ | $35-$49 | 3.9 | 15 days |

| Figo | B | $22-$27 | 4.5 | 1 days |

| Paw Protect | B+ | $52-$64 | 4.0 | 14 days |

| Nationwide | A+ | $35-$50 | 4.2 | 14 days |

Lemonade may offer shorter waiting periods depending on your location.

5. Spot Pet Insurance: Cost Analysis

The average monthly cost for Spot pet insurance is $51, which is slightly higher than the national average of $46. However, Spot’s customizable options allow for more affordable coverage.

5.1. Spot Pet Insurance: Premiums and Coverage

| Plan | Cat Insurance | Dog Insurance | Average Cost | Coverage Summary |

|---|---|---|---|---|

| Accident-Only | $9 | $13 | $11 | Covers treatments and services related to accidents. |

| Accident and Illness | $30 | $68 | $51 | Covers illnesses, accidents, and injuries. |

| Preventative Care (Gold/Platinum) | $10–$25 | $10–$25 | $10–$25 | Reimbursement for preventative services like wellness exams and vaccines. |

Spot also provides a 30-day money-back guarantee, refunding the initial premium if no claims are filed during that period.

5.2. Spot Pet Insurance: Cost Variation by Breed

Spot pet insurance costs differ based on breed due to factors like predisposed health issues and breed size. Here are sample monthly costs for a 1-year-old dog of various popular breeds:

| Breed | Monthly Cost |

|---|---|

| Golden Retriever | $19.57 |

| Labrador Retriever | $19.57 |

| French Bulldog | $28.23 |

| Chihuahua | $9.29 |

| German Shepherd | $16.61 |

| Yorkshire Terrier | $11.30 |

| Shih Tzu | $10.01 |

| Goldendoodle | $13.44 |

| Pit Bull | $20.94 |

| Maltese | $11.30 |

Prices reflect an accident and illness policy with a $2,500 annual limit, a 70% reimbursement rate, and a $500 deductible. Prices are accurate as of August 2024.

5.3. Spot Pet Insurance: Cost Variation by Age

Similar to other pet insurance companies, Spot policy prices increase as the pet ages. The table below shows sample monthly costs for a medium mixed-breed male dog at different ages:

| Age | Monthly Cost |

|---|---|

| 8 months | $13.44 |

| 1 year | $13.44 |

| 3 years | $13.44 |

| 5 years | $17.74 |

| 7 years | $25.09 |

| 9 years | $37.80 |

| 11 years | $51.01 |

| 13 years | $63.82 |

| 15 years | $70.95 |

Prices reflect an accident and illness policy with a $2,500 annual limit, a 70% reimbursement rate, and a $500 deductible. Prices are accurate as of August 2024.

5.4. Spot Pet Insurance: Average Cost Compared to Competitors

The following table compares Spot’s average policy cost to those of its top competitors:

| Company | Average Monthly Cost (Dog) | Average Monthly Cost (Cat) |

|---|---|---|

| Spot Pet Insurance | $51 | $30 |

| Lemonade | $47 | $28 |

| ASPCA Pet Health Insurance | $44 | $26 |

| Fetch Pet Insurance | $46 | $27 |

| Embrace | $58 | $35 |

| Healthy Paws | $42 | $25 |

| Figo | $25 | $15 |

| Nationwide | $43 | $26 |

6. Spot Pet Insurance: Coverage Details

Spot offers accident-only and accident and illness plans, with optional Gold and Platinum wellness add-ons for preventive care. The accident and illness plan covers alternative therapies, behavioral issues, and hereditary conditions, some of which are not standard in competitors’ plans.

6.1. Spot Pet Insurance: Plan Offerings

| Condition or Treatment | Accident and Illness | Accident-Only |

|---|---|---|

| Advanced Care | ✓ | |

| Alternative Therapies | ✓ | ✓ |

| Behavioral Issues | ✓ | |

| Cancer and Growths | ✓ | |

| Dental Illnesses | ✓ | |

| Diagnostics and Treatments | ✓ | |

| Digestive Illnesses | ✓ | |

| Emergencies and Hospitalizations | ✓ | |

| Hereditary Conditions | ✓ | |

| Hip Dysplasia | ✓ | |

| Infectious Diseases | ✓ | |

| IV Fluids | ✓ | ✓ |

| Medical Supplies | ✓ | ✓ |

| Microchip Implantation | ✓ | ✓ |

| MRI, CT Scans, or X-Rays | ✓ | |

| Orthopedic | ✓ | |

| Poison Control Consultation Fees | ✓ | |

| Prescription Medications | ✓ | ✓ |

| Skin, Eye, and Ear Infections | ✓ | |

| Surgery and Specialized Care | ✓ | ✓ |

| Swallowed Objects and Toxins | ✓ | |

| Tooth Extractions | ✓ | |

| Vet Exam Fees | ✓ | |

| Virtual Vet Visits | ✓ | |

| X-Rays and Testing | ✓ |

Spot typically excludes coverage for cosmetic procedures, boarding costs, pre-existing conditions, and costs related to breeding, pregnancy, whelping, or nursing.

6.2. Spot Pet Insurance: Preventative Care Plans

Spot provides two wellness care packages that can be added to the base plan to cover certain vaccines, annual exams, and more.

| Service Covered | Gold Wellness Plan ($10/month) | Platinum Wellness Plan ($25/month) |

|---|---|---|

| Dental Cleaning* | $100 | $150 |

| Wellness Exam | $50 | $50 |

| Flea and Heartworm Prevention | Not covered | $25 |

| Deworming | $20 | $25 |

| Spay or Neuter Procedure* | Not covered | $150 |

| Vaccines (Rabies, Lyme, FIP) | $20 | $25 |

| Urinalysis | Not covered | $25 |

| Blood Test | Not covered | $25 |

The Gold Plan includes $100 for dental cleanings and does not cover spay or neuter procedures. The Platinum Plan includes a $150 benefit for either dental cleaning or spay/neuter procedures.

6.3. Spot Pet Insurance: Customizable Coverage Levels

Spot stands out for its customizable plan options, allowing pet owners to tailor their coverage to meet specific needs and budgets.

For example, an accident and illness plan with a Platinum preventive care add-on, a $500 deductible, a 70% reimbursement rate, and a $2,500 annual coverage limit would cost $53 per month for a 2-year-old golden retriever in North Carolina.

6.4. Spot Pet Insurance: Deductible Options

Premiums vary depending on the chosen deductible:

- $1,000 deductible: $43

- $750 deductible: $48

- $500 deductible: $52

- $250 deductible: $60

- $100 deductible: $67

6.5. Spot Pet Insurance: Reimbursement Rates

Spot offers three reimbursement rate options:

- 70% reimbursement: $51

- 80% reimbursement: $57

- 90% reimbursement: $69

6.6. Spot Pet Insurance: Annual Limit Options

Spot provides seven annual coverage limit options:

- $2,500 annual limit: $51

- $3,000 annual limit: $54

- $4,000 annual limit: $57

- $5,000 annual limit: $58

- $7,000 annual limit: $69

- $10,000 annual limit: $72

- Unlimited coverage: $93

7. Spot Pet Insurance: A Hands-On Experience

To gain a deeper understanding of the customer experience with pet insurance providers like Spot, our team undertook the process of purchasing a pet insurance plan directly from the company. In June 2024, we acquired an accident and illness policy through Spot, featuring a $500 deductible, an 80% reimbursement rate, and a $5,000 annual limit, specifically for Oliver, a 4-year-old Pembroke Welsh Corgi. Oliver, who is owned by one of our team members, graciously volunteered to enroll in the coverage as part of our research efforts.

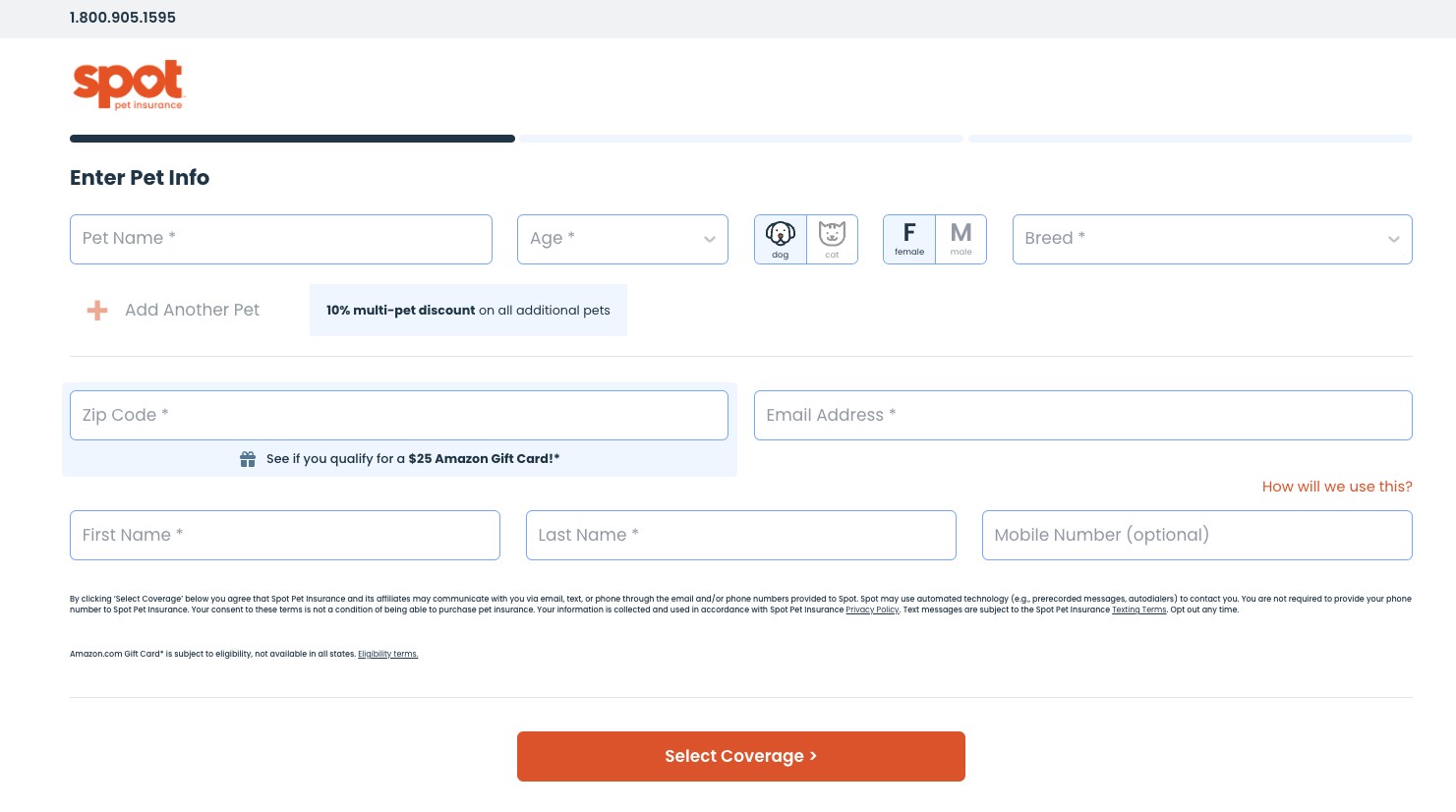

Our team members were able to sign up in under two minutes because Spot doesn’t ask for a lot of information. They said the following when asked what they enjoyed most about the buying process:

“I appreciate how easy and straightforward Spot made it to sign up for a plan. Because you don’t need a lot of information to start insuring your pet, I was able to get the coverage that best suits their needs with the fewest number of steps. A smooth and effective registration procedure was ensured by the clear instructions and limited options, as well as transparent pricing for both annual and monthly costs.”

When asked if anything was perplexing or challenging during the sign-up process, our team members pointed out that the policy’s waiting period was not fully explained and that the description of coverage restrictions was a little confusing. We contacted Spot to inquire about their coverage explanation but received no response.

I would rate the overall buying experience about 3.8 out of 5 stars. I love the idea of knowing that for $33 a month, a four-legged piece of my heart will be fully covered if anything were to happen to him.

—MarketWatch Guides team member

8. Spot Pet Insurance: Navigating Sign-Up, Claims, and Payouts

Spot streamlines the process for pet parents to request quotes and sign up. Below is an outline of the enrollment process.

8.1. Spot Pet Insurance: Signing Up

1. Get a Quote: Begin by requesting a complimentary quote online or by phone. Head to the Spot website and click the “Click For Price” button, or call 1-800-905-1595.

2. Choose Your Coverage: Spot provides various coverage options, including standard pet insurance plans and Gold and Platinum wellness care add-ons.

8.2. Spot Pet Insurance: Filing a Claim

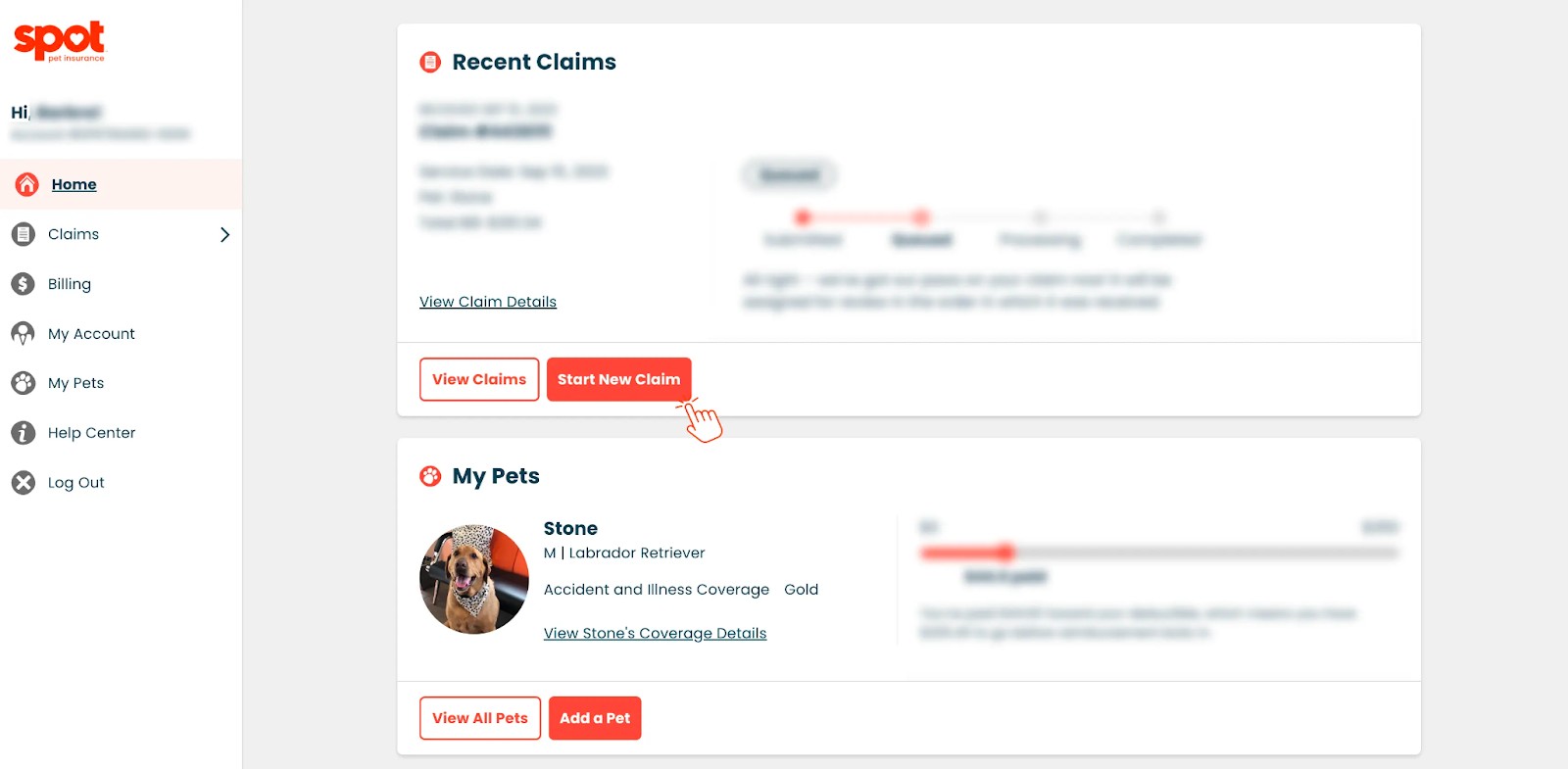

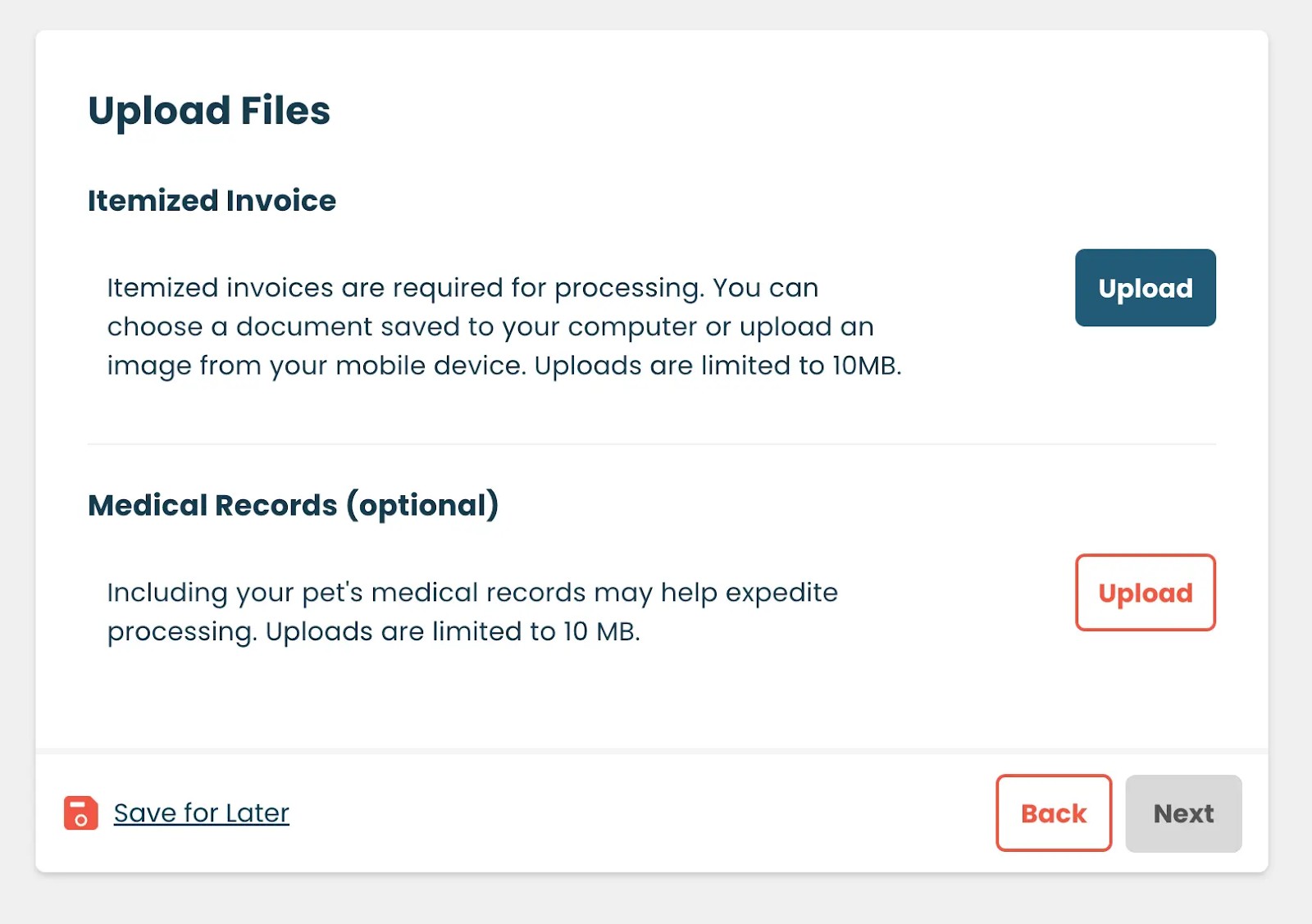

Spot provides clear instructions for filing a claim. Log in to your Member Center Portal in your mobile app or web browser. Click “Start New Claim” on your home page or the “Claims” tab.

Choose the pet you’re filing a claim for and complete all relevant information, including the treatment, condition, and the name of your veterinarian clinic. Upload an itemized invoice that includes the costs and services. Although uploading an invoice is optional, it can speed up the claims procedure.

Spot estimates that accident and illness claims take 5-7 business days to process, while preventive claims take two business days. The Spot Member Center portal allows you to track claims and access resources like frequently asked questions (FAQ) and a 24/7 pet telehealth helpline provided by VetAccess.

Third-party customer reviews on Trustpilot suggest varying experiences with Spot’s claims process. While some customers praised the ease and speed of filing claims via the app and the helpfulness of phone representatives, others mentioned concerns about Spot’s lack of weekend hours and denied claims.

9. Spot Pet Insurance: Waiting Periods

Spot Pet Insurance does have waiting periods. The waiting period is 14 days for accidents, illnesses, and cruciate ligament events. The waiting period for a preventive care add-on is 24 hours.

10. Spot Pet Insurance: Waiting Periods vs. Competitors

| Company | Accident Waiting Period | Illness Waiting Period |

|---|---|---|

| Spot Pet Insurance | 14 days | 14 days |

| Lemonade | 2 days* | 14 days |

| ASPCA Pet Health Insurance | 14 days | 14 days |

| Fetch Pet Insurance | Up to 15 days | 15 days |

| Embrace | 2 days | 14 days |

| Healthy Paws | 15 days | 15 days |

| Figo | 1 day | 14 days |

| Nationwide | 14 days | 14 days |

*Lemonade may offer shorter waiting periods depending on where you live.

11. Spot Pet Insurance: Age Restrictions

Spot does not impose an upper age limit for enrolling your pet. However, your pet must be at least 8 weeks old to qualify for coverage.

12. Spot Pet Insurance: What Customers Are Saying

Customer reviews on platforms like Trustpilot and the Better Business Bureau (BBB) offer insights into the experiences of Spot Pet Insurance customers.

12.1. Spot Pet Insurance: Positive Feedback

Customers frequently praise:

- Easy Enrollment Process: Many customers find the sign-up process straightforward and quick.

- Customizable Coverage: The ability to tailor plans to specific needs is a significant advantage.

- Comprehensive Coverage Options: The inclusion of alternative therapies and behavioral issues in standard plans is well-received.

- Helpful Customer Service: Many reviewers appreciate the responsiveness and knowledge of customer service representatives.

12.2. Spot Pet Insurance: Areas for Improvement

Dissatisfied customers often mention:

- Denied Claims: Some customers report issues with claims being denied.

- Customer Service Limitations: The lack of weekend customer service hours is a common complaint.

- Inconsistent Claims Processing: Some customers experience lengthy processing times for claims.

13. Spot Pet Insurance: Competitive Analysis

Below is a comparison between Spot and two of its leading competitors, Trupanion and Healthy Paws, to assist you in making an informed decision based on your individual requirements.

13.1. Spot Pet Insurance vs. Trupanion

Trupanion, established in Canada in 2000 and expanded to the U.S. in 2008, offers customizable deductibles similar to Spot. However, key differences exist between the two providers.

Unlike Spot, Trupanion provides unlimited annual limits across all its plans, and its reimbursement percentage is consistently 90%. Affordability may be a concern with Trupanion. Trupanion’s average cost for dogs is approximately $88, which is more than 70% higher than Spot’s average premium.

13.2. Spot Pet Insurance vs. Healthy Paws

Spot and Healthy Paws provide similar plan customization options for deductibles, with choices ranging from $100 to $1,000.

When it comes to cost, Spot and Healthy Paws have similar average premiums for both dogs and cats, with Healthy Paws being slightly more affordable.

14. Choosing the Right Pet Insurance Company

Understanding what factors influence pet owners’ choice of insurer, we surveyed participants in our April 2024 pet insurance survey to find the main reasons for their decision.

14.1. Factors to Consider When Choosing Pet Insurance

- Coverage Options: Ensure the plan covers your pet’s specific needs, including illnesses, accidents, and routine care.

- Cost and Deductibles: Compare monthly premiums, deductibles, and reimbursement rates.

- Customer Reviews: Research customer feedback on claims processing and customer service.

- Waiting Periods: Check the waiting periods for different conditions and treatments.

- Age and Breed Restrictions: Confirm there are no age or breed restrictions that may affect coverage.

15. Is Spot Good Pet Insurance: Making the Right Choice

Deciding whether Spot Pet Insurance is worthwhile depends on your individual circumstances and pet’s needs. Factors like your pet’s age, health history, breed, and any pre-existing conditions should influence your decision.

Dr. Sarah Proctor, a veterinarian and clinical associate professor at the University of New Hampshire, offers insight on the types of pet owners who benefit most from pet insurance:

“Catastrophic [pet insurance] coverage is best for someone who can budget for the insurance premium but would not have money to pay an unexpected emergency [vet] bill. If someone has a healthy pet and does regular routine preventive care, and they have enough savings to cover the one-time unexpected cost, perhaps they can do without insurance. However, a $10,000 bill is not easy to cover for most people. I’d say if you can’t afford $10,000 out of pocket tomorrow, you should get insurance.”

Visit PETS.EDU.VN for personalized recommendations and resources to help you make an informed decision about pet insurance. Contact us at 789 Paw Lane, Petville, CA 91234, United States or Whatsapp: +1 555-987-6543.

16. Frequently Asked Questions

16.1. Can I visit any vet with Spot Pet Insurance?

Yes, Spot plans allow you to visit any licensed vet in North America. Pay for vet services at the time of treatment, then file reimbursement claims with Spot.

16.2. Is Spot Pet Insurance the same as ASPCA Pet Health Insurance?

Spot and ASPCA Pet Health Insurance are underwritten by the same companies, but they are not the same. Spot offers plans with different deductibles and coverage amounts, as well as variations in covered services and treatments.

16.3. Does Spot Pet Insurance cover MRIs and ultrasounds?

Spot pet insurance plans cover diagnostic tests, including MRIs and ultrasounds, if needed, to diagnose covered medical conditions. Check your plan details for specific coverage.

16.4. What does Spot Pet Insurance not cover?

Spot pet insurance does not cover pre-existing conditions, elective or cosmetic procedures, grooming and hygiene, boarding, or pet sitting.

17. Methodology: Rating Pet Insurance Companies

Each pet insurance company is assessed based on factors important to pet parents. Our process includes in-depth research, comparing coverage options, gathering quotes, and reviewing customer feedback. We surveyed 3,000 dog and cat owners and purchased pet insurance plans for 10 team members’ pets to test customer experiences.

Each provider is scored on a 100-point scale, resulting in an overall rating out of five stars.

18. Pet Insurance: Connect With PETS.EDU.VN

Choosing the right pet insurance involves several considerations. With Spot Pet Insurance, you have the opportunity to explore custom plans and flexible coverage. At PETS.EDU.VN, we understand the challenges pet owners face when selecting suitable insurance coverage. Our site offers comprehensive resources and professional guidance.

Don’t navigate the complexities of pet insurance alone. Contact us at PETS.EDU.VN, where our team can provide in-depth answers and personalized advice. Contact us at 789 Paw Lane, Petville, CA 91234, United States or Whatsapp: +1 555-987-6543. Let us guide you through the options to find the perfect fit for your pet’s needs. With pets.edu.vn, secure the best care for your beloved companions.