Is Nationwide Pet Insurance Going Out Of Business? Discover the facts and protect your furry friend with alternative coverage options discussed here at PETS.EDU.VN. Learn about pet insurance alternatives, policy changes, and maintain continuous pet coverage.

1. Understanding the Nationwide Pet Insurance Non-Renewal Issue

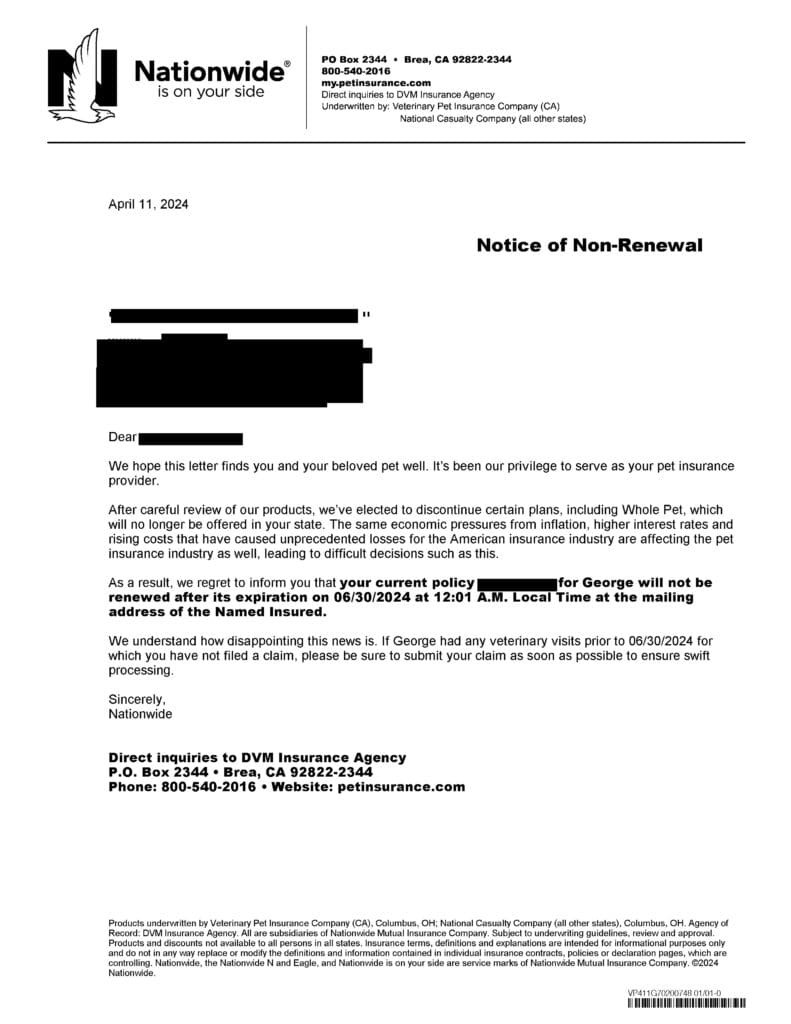

Nationwide Pet Insurance is currently facing scrutiny as they have started sending out non-renewal letters to many of their policyholders. This has led to widespread concern and confusion among pet owners who rely on these policies for their pets’ healthcare needs. The primary concern revolves around understanding why these non-renewals are happening and what options are available for those affected. Alison Seltzer Friedman, a concerned pet owner, voiced her frustration on Facebook, highlighting the abrupt cancellation of her 15-year-old dog Lizzie’s policy. This situation reflects a broader issue where numerous policyholders are receiving similar notices, leading to uncertainty about their pet insurance coverage.

Alison Seltzer Friedman's Facebook post about Nationwide Pet Insurance non-renewal

Alison Seltzer Friedman's Facebook post about Nationwide Pet Insurance non-renewal

Nationwide has not officially disclosed the exact reasons for these non-renewals or the number of policies affected. Requests for comments from key Nationwide figures, including CEO Kirt Walker and veterinary officers Jules Belson and Emily Tincher, have gone unanswered. This lack of transparency has fueled speculation and anxiety among policyholders, who are left wondering about the future of their pet insurance coverage. According to a former Nationwide executive, the company is experiencing financial difficulties. “Cancelling Whole Pet With Wellness policies is a pretty drastic step from a public relations perspective. I’m sure the pets protected under those policies are older and will be more difficult to insure by other companies,” the executive noted, suggesting that older pets with existing health conditions may be disproportionately affected.

2. Potential Impact on Policyholders and the Pet Insurance Market

The non-renewal of Nationwide Pet Insurance policies could impact at least 300,000 policyholders, according to another former pet insurance executive. This large-scale change in coverage forces pet owners to seek alternative insurance options, potentially disrupting the pet insurance market. For many, this means navigating new policies and providers, often with the added challenge of finding coverage for older pets or those with pre-existing conditions. The situation has raised questions about the stability and trustworthiness of pet insurance providers. Birny Birnbaum, a recently retired consumer advocate from the National Association of Insurance Commissioners (NAIC), criticized Nationwide’s actions, comparing them to tactics used in the long-term care insurance industry. “This is the long-term care insurance playbook — close out one product, offer the new product to folks with less likelihood of a future claim and leave those who paid for years out in the cold. Any regulator worth their salt would stop this action — it is essentially post-claims underwriting. Even if the justification about higher claim costs were true, then the solution is to file for higher rates.”

The lack of comment from major competitors like Trupanion, Inc., further complicates the landscape. The silence from industry leaders raises concerns about the overall health of the pet insurance market and what measures are being taken to protect consumers. This situation underscores the need for greater transparency and regulatory oversight in the pet insurance industry.

3. Exploring Alternative Pet Insurance Options

For pet owners affected by Nationwide’s non-renewal policies, it’s crucial to explore alternative pet insurance options to ensure continuous coverage for their beloved animals. Here are some strategies to help you find the best fit for your pet’s needs:

- Research Different Providers:

- Trupanion: Known for its vet-direct payment system and comprehensive coverage.

- Pets Best: Offers customizable plans with various deductible and reimbursement options.

- Embrace: Provides a diminishing deductible and covers curable pre-existing conditions.

- Healthy Paws: Offers unlimited annual payouts and comprehensive coverage.

- Compare Coverage and Costs:

| Feature | Trupanion | Pets Best | Embrace | Healthy Paws |

|---|---|---|---|---|

| Vet Direct Payment | Yes | No | No | No |

| Customizable Plans | No | Yes | Yes | No |

| Deductible | Per condition or annual | Annual | Annual | Annual |

| Pre-existing Cond. | Not covered (except curable with Embrace) | Not covered | Curable conditions covered after waiting period | Not covered |

| Annual Payout Limit | Unlimited | Customizable | Customizable | Unlimited |

-

Consider Factors Beyond Price:

- Coverage Details: Look for policies that cover a wide range of conditions, including accidents, illnesses, and hereditary conditions.

- Deductibles and Reimbursement Rates: Understand how deductibles and reimbursement rates affect your out-of-pocket costs.

- Exclusions: Be aware of any exclusions, such as pre-existing conditions or breed-specific issues.

-

Read Reviews and Seek Recommendations:

- Online Reviews: Check customer reviews on sites like Trustpilot and the Better Business Bureau.

- Veterinarian Recommendations: Ask your vet for recommendations based on their experience with different insurance providers.

-

Act Quickly:

- Avoid Gaps in Coverage: Enroll in a new policy as soon as possible to avoid any gaps in coverage, especially for older pets or those with existing health issues.

By carefully researching and comparing different options, pet owners can find a suitable pet insurance policy that provides peace of mind and financial protection for their pets’ healthcare needs. Remember, at PETS.EDU.VN, we offer a wealth of information and resources to help you make informed decisions about your pet’s health and well-being.

4. Strategies for Continuous Pet Coverage

Maintaining continuous pet coverage is essential, especially as pets age and become more susceptible to health issues. Here are some strategies to help you ensure your pet remains protected:

- Enroll Early:

- Start Young: Enroll your pet in an insurance plan while they are young and healthy to secure the best rates and coverage options.

- Avoid Pre-Existing Conditions: Enrolling early can help avoid exclusions for pre-existing conditions that may develop later in life.

- Review Policy Terms Regularly:

- Annual Review: Review your policy terms and coverage annually to ensure they still meet your pet’s needs.

- Update Coverage: Update your coverage as needed to reflect changes in your pet’s health or lifestyle.

- Avoid Lapses in Coverage:

- Automatic Payments: Set up automatic payments to avoid accidental lapses in coverage due to missed payments.

- Renewal Reminders: Keep track of your policy renewal dates and ensure you renew on time.

- Consider a Supplemental Policy:

- Additional Coverage: If your primary policy has limitations, consider a supplemental policy to cover specific needs, such as dental care or alternative therapies.

- Wellness Plans: Some companies offer wellness plans that cover routine care, such as vaccinations and check-ups, which can complement your insurance policy.

- Maintain Accurate Records:

- Veterinary Records: Keep accurate records of your pet’s veterinary visits and medical history.

- Claims History: Track your claims history to identify any patterns or trends that may affect your coverage.

- Shop Around Before Renewing:

- Compare Rates: Before renewing your policy, shop around to compare rates and coverage options from other providers.

- Negotiate Terms: Negotiate with your current provider to see if they can match or beat the competition’s rates.

- Understand Policy Changes:

- Stay Informed: Stay informed about any changes to your policy terms or coverage.

- Contact Provider: Contact your insurance provider if you have questions or concerns about your coverage.

By implementing these strategies, you can ensure that your pet remains continuously covered, providing you with peace of mind and financial security in the event of unexpected veterinary expenses.

5. Key Considerations When Choosing a New Pet Insurance Provider

Choosing the right pet insurance provider involves careful consideration of various factors to ensure the policy meets your pet’s specific needs and your financial situation. Here are some key considerations to keep in mind:

- Coverage Options:

- Comprehensive Coverage: Look for policies that cover accidents, illnesses, hereditary conditions, and congenital conditions.

- Emergency Care: Ensure the policy covers emergency care, including hospital stays and surgeries.

- Specialized Treatments: Check if the policy covers specialized treatments, such as chemotherapy, acupuncture, and physical therapy.

- Deductibles and Reimbursement Rates:

- Deductible Options: Understand the different deductible options and how they affect your monthly premiums.

- Reimbursement Rates: Choose a reimbursement rate that fits your budget and risk tolerance.

- Annual Payout Limits: Consider the annual payout limits and whether they are sufficient for your pet’s potential healthcare needs.

- Exclusions and Limitations:

- Pre-Existing Conditions: Be aware of any exclusions for pre-existing conditions.

- Waiting Periods: Understand the waiting periods before coverage begins for different types of treatments.

- Breed-Specific Conditions: Check if the policy excludes coverage for breed-specific conditions.

- Customer Service and Claims Process:

- Customer Reviews: Read customer reviews to assess the provider’s customer service reputation.

- Claims Process: Understand the claims process and how easy it is to submit and track claims.

- Payment Options: Check the payment options and whether the provider offers direct payment to veterinarians.

- Company Reputation and Financial Stability:

- Financial Ratings: Check the provider’s financial ratings to ensure they are financially stable and capable of paying claims.

- Years in Business: Consider the provider’s years in business as an indicator of their experience and reliability.

- Industry Recognition: Look for industry recognition or awards that the provider has received.

- Additional Benefits and Features:

- Wellness Plans: Some providers offer wellness plans that cover routine care, such as vaccinations and check-ups.

- Discounts: Check for discounts, such as multi-pet discounts or discounts for military personnel or seniors.

- 24/7 Vet Helpline: Some providers offer a 24/7 vet helpline for immediate advice and support.

By carefully evaluating these considerations, you can make an informed decision and choose a pet insurance provider that provides the best coverage and value for your pet. At PETS.EDU.VN, we strive to provide you with the resources and information you need to make the best choices for your pet’s health and well-being.

6. Navigating Policy Changes and Understanding Your Rights

Policy changes can be confusing and frustrating, but understanding your rights as a policyholder is essential. Here’s how to navigate policy changes effectively:

- Review Your Policy Documents:

- Read the Fine Print: Carefully review your policy documents, including the terms and conditions, to understand your coverage and any limitations.

- Understand Your Rights: Familiarize yourself with your rights as a policyholder, including the right to appeal decisions and the right to receive clear and accurate information.

- Stay Informed About Policy Changes:

- Notifications: Pay attention to any notifications from your insurance provider about policy changes, such as changes to coverage, premiums, or deductibles.

- Updates: Check your provider’s website or contact them directly for updates on policy changes.

- Understand the Reasons for Changes:

- Ask Questions: If you receive a notice about a policy change, ask your provider for a clear explanation of the reasons behind the change.

- Request Documentation: Request documentation to support the reasons for the change, such as actuarial data or market analysis.

- Assess the Impact of Changes:

- Evaluate Coverage: Assess how the policy changes will impact your coverage and whether it still meets your pet’s needs.

- Consider Alternatives: If the changes significantly reduce your coverage or increase your premiums, consider exploring alternative insurance options.

- Negotiate with Your Provider:

- Request Exceptions: If you are unhappy with the policy changes, try negotiating with your provider to see if they can make exceptions or offer alternative solutions.

- Provide Feedback: Provide feedback to your provider about your concerns and how the changes will affect you.

- File a Complaint If Necessary:

- Contact Regulatory Agencies: If you believe your insurance provider has acted unfairly or violated your rights, file a complaint with your state’s insurance regulatory agency.

- Seek Legal Advice: Consider seeking legal advice from an attorney specializing in insurance law.

- Document Everything:

- Keep Records: Keep detailed records of all communications with your insurance provider, including dates, times, and the names of the representatives you spoke with.

- Save Documents: Save all policy documents, notifications, and other relevant information in a safe place.

By understanding your rights and taking proactive steps to navigate policy changes, you can protect your pet’s coverage and ensure you receive fair treatment from your insurance provider.

7. The Role of Regulatory Oversight in Pet Insurance

Regulatory oversight plays a crucial role in protecting consumers and ensuring fair practices within the pet insurance industry. Here’s what you need to know about the role of regulatory oversight:

- Consumer Protection:

- Fair Practices: Regulatory agencies oversee pet insurance providers to ensure they adhere to fair business practices and treat policyholders fairly.

- Transparency: These agencies promote transparency in the industry by requiring providers to disclose policy terms, coverage limitations, and exclusions clearly.

- Financial Stability:

- Solvency: Regulatory bodies monitor the financial stability of pet insurance companies to ensure they can meet their obligations to policyholders.

- Risk Management: They assess the risk management practices of providers to prevent financial distress and protect consumers from potential losses.

- Complaint Resolution:

- Investigation: Regulatory agencies investigate consumer complaints against pet insurance providers and take appropriate action to resolve disputes.

- Enforcement: They have the authority to enforce regulations and impose penalties on providers that violate consumer protection laws.

- Market Regulation:

- Competition: Regulatory oversight promotes competition in the pet insurance market by preventing anti-competitive practices and ensuring a level playing field for all providers.

- Innovation: It encourages innovation by fostering an environment where providers can develop new products and services without engaging in deceptive or misleading practices.

- Licensing and Accreditation:

- Standards: Regulatory agencies set standards for licensing and accrediting pet insurance providers to ensure they meet minimum requirements for competence and ethical conduct.

- Qualifications: They verify the qualifications and experience of insurance professionals to protect consumers from unqualified or unscrupulous individuals.

- Education and Outreach:

- Information: Regulatory bodies provide education and outreach programs to help consumers understand their rights and make informed decisions about pet insurance.

- Resources: They offer resources and tools to assist consumers in comparing policies, filing complaints, and resolving disputes with providers.

By providing oversight and enforcement, regulatory agencies help maintain a fair and transparent pet insurance market that protects consumers and promotes the responsible growth of the industry.

8. The Future of Pet Insurance: Trends and Predictions

The pet insurance industry is continuously evolving, driven by increasing pet ownership and advances in veterinary medicine. Here are some trends and predictions for the future of pet insurance:

- Increased Adoption:

- Growing Market: The pet insurance market is expected to continue growing as more pet owners recognize the value of insurance in managing veterinary costs.

- Millennial and Gen Z Drivers: Millennials and Gen Z are driving the growth of the market as they are more likely to insure their pets than older generations.

- Technological Advancements:

- Telehealth Integration: Telehealth services are becoming more integrated into pet insurance policies, allowing pet owners to access veterinary care remotely.

- AI-Powered Claims Processing: Artificial intelligence (AI) is being used to streamline claims processing, reduce fraud, and improve customer service.

- Customized Policies:

- Personalized Coverage: Pet insurance providers are offering more customized policies to meet the specific needs of individual pets and their owners.

- Flexible Options: This includes options such as customizable deductibles, reimbursement rates, and annual payout limits.

- Focus on Preventive Care:

- Wellness Plans: More policies are including wellness plans that cover routine care, such as vaccinations, dental cleanings, and annual check-ups.

- Early Detection: These plans emphasize preventive care to help detect and address health issues early, reducing the need for expensive treatments later on.

- Integration with Veterinary Practices:

- Direct Payment Options: More pet insurance providers are offering direct payment options to veterinary practices, making it easier for pet owners to manage their bills.

- Partnerships: Partnerships between insurance providers and veterinary practices are becoming more common, allowing for seamless coordination of care.

- Regulatory Changes:

- Increased Oversight: Regulatory agencies are likely to increase their oversight of the pet insurance industry to protect consumers and ensure fair practices.

- Standardization: Efforts to standardize policy terms and coverage options may emerge to make it easier for consumers to compare different plans.

- Expansion of Coverage:

- Alternative Therapies: More policies are covering alternative therapies, such as acupuncture, chiropractic care, and herbal medicine.

- Behavioral Treatments: Coverage for behavioral treatments is also expanding as pet owners recognize the importance of addressing mental health issues in their pets.

These trends and predictions suggest that the pet insurance industry will continue to evolve to meet the changing needs of pet owners and the advancements in veterinary medicine.

9. Expert Advice on Managing Pet Healthcare Costs

Managing pet healthcare costs can be challenging, but with careful planning and proactive strategies, you can ensure your pet receives the best possible care without breaking the bank. Here’s some expert advice to help you manage pet healthcare costs:

- Preventive Care:

- Regular Check-Ups: Schedule regular check-ups with your veterinarian to detect and address health issues early.

- Vaccinations: Keep your pet up-to-date on vaccinations to prevent common diseases.

- Parasite Control: Use preventative medications to control fleas, ticks, and heartworms.

- Pet Insurance:

- Research Policies: Research different pet insurance policies to find one that fits your budget and provides adequate coverage for your pet’s needs.

- Enroll Early: Enroll your pet in an insurance plan while they are young and healthy to secure the best rates and coverage options.

- Budgeting:

- Create a Pet Budget: Create a budget to track your pet-related expenses, including food, toys, grooming, and healthcare.

- Emergency Fund: Set aside money in an emergency fund to cover unexpected veterinary costs.

- Negotiate Costs:

- Ask for Estimates: Ask your veterinarian for written estimates before agreeing to any treatments or procedures.

- Discuss Payment Options: Discuss payment options with your veterinarian, such as payment plans or financing.

- Generic Medications:

- Inquire About Alternatives: Ask your veterinarian if there are generic alternatives to expensive medications.

- Compare Prices: Compare prices at different pharmacies to find the best deals on medications.

- Home Care:

- Learn Basic Skills: Learn basic pet care skills, such as administering medications, cleaning ears, and trimming nails.

- Monitor Health: Monitor your pet’s health closely and report any changes or concerns to your veterinarian.

- Nutrition:

- High-Quality Food: Feed your pet a high-quality diet to support their overall health and prevent diet-related illnesses.

- Avoid Overfeeding: Avoid overfeeding your pet to prevent obesity and related health problems.

- Community Resources:

- Low-Cost Clinics: Look for low-cost veterinary clinics or spay/neuter clinics in your area.

- Animal Shelters: Contact local animal shelters or rescue organizations for assistance with pet care costs.

By following these expert tips, you can effectively manage your pet healthcare costs and ensure your beloved companion receives the care they need without straining your finances.

10. PETS.EDU.VN: Your Comprehensive Resource for Pet Care Information

At PETS.EDU.VN, we understand the challenges and joys of pet ownership. Our mission is to provide you with comprehensive, reliable, and up-to-date information to help you make the best decisions for your pet’s health and well-being. Here’s how PETS.EDU.VN can be your go-to resource for pet care information:

- Expert Articles and Guides:

- Wide Range of Topics: Access a wide range of articles and guides covering various topics, including pet health, nutrition, behavior, training, and grooming.

- Expert Contributors: Our content is created by experienced veterinarians, trainers, and pet care professionals.

- Detailed Breed Information:

- Comprehensive Profiles: Explore detailed breed profiles to learn about the characteristics, health issues, and care requirements of different dog and cat breeds.

- Choosing the Right Pet: Use our breed information to help you choose the right pet for your lifestyle and preferences.

- Health and Wellness Resources:

- Symptom Checker: Use our symptom checker to identify potential health issues based on your pet’s symptoms.

- Disease Information: Access detailed information about common pet diseases and conditions, including symptoms, causes, treatments, and prevention tips.

- Training and Behavior Tips:

- Expert Advice: Get expert advice on training your pet and addressing common behavior issues.

- Step-by-Step Guides: Follow our step-by-step guides to teach your pet basic commands and tricks.

- Nutrition and Diet Information:

- Feeding Guidelines: Learn about proper nutrition and feeding guidelines for different types of pets.

- Dietary Needs: Understand the dietary needs of your pet based on their age, breed, and health condition.

- Product Reviews and Recommendations:

- Unbiased Reviews: Read unbiased reviews and recommendations for pet food, toys, supplies, and other products.

- Top-Rated Products: Discover top-rated products based on expert reviews and customer feedback.

- Community Forum:

- Connect with Other Pet Owners: Connect with other pet owners in our community forum to share experiences, ask questions, and get support.

- Expert Advice: Get expert advice from our team of veterinarians and pet care professionals in the forum.

Whether you’re a new pet owner or an experienced pet parent, PETS.EDU.VN is here to support you every step of the way. Visit our website at PETS.EDU.VN to explore our resources and join our community. For personalized assistance, you can reach us at 789 Paw Lane, Petville, CA 91234, United States, or contact us via Whatsapp at +1 555-987-6543.

Conclusion

The uncertainty surrounding Nationwide Pet Insurance’s non-renewal policies highlights the importance of staying informed and proactive in managing your pet’s healthcare coverage. By understanding your rights, exploring alternative options, and maintaining continuous coverage, you can ensure that your furry friend receives the care they deserve without financial strain. Remember, PETS.EDU.VN is here to provide you with the resources and information you need to make informed decisions about your pet’s health and well-being.

FAQ: Nationwide Pet Insurance and Policy Non-Renewals

1. Why is Nationwide Pet Insurance non-renewing policies?

Nationwide has not officially disclosed the exact reasons. However, a former executive mentioned the company is facing financial difficulties.

2. How many policyholders are affected by this non-renewal?

According to a former pet insurance executive, at least 300,000 policyholders may be affected.

3. What should I do if I received a non-renewal letter from Nationwide?

Start researching alternative pet insurance options immediately to ensure continuous coverage for your pet.

4. What alternative pet insurance providers should I consider?

Consider providers like Trupanion, Pets Best, Embrace, and Healthy Paws. Compare coverage options, deductibles, and reimbursement rates.

5. Can I get pet insurance for an older pet with pre-existing conditions?

It may be more challenging, but some companies like Embrace cover curable pre-existing conditions after a waiting period.

6. What is the role of regulatory oversight in pet insurance?

Regulatory oversight protects consumers by ensuring fair practices, financial stability, and transparency within the pet insurance industry.

7. How can I manage my pet’s healthcare costs effectively?

Focus on preventive care, budget for pet expenses, consider pet insurance, and negotiate costs with your veterinarian.

8. What are some trends in the pet insurance industry?

Trends include increased adoption, technological advancements, customized policies, and a focus on preventive care.

9. How can PETS.EDU.VN help me with pet care information?

PETS.EDU.VN offers expert articles, detailed breed information, health and wellness resources, training tips, and a community forum.

10. Where can I find reliable information about pet insurance and pet care?

pets.edu.vn is a comprehensive resource for pet care information. You can also consult with your veterinarian and read reviews from other pet owners.