Founded in 2011, Chewy embarked on an ambitious journey: to challenge established retail and e-commerce giants and carve out a specialized marketplace for pet owners. Today, it’s clear that Chewy Pet Food Company has not only met but exceeded expectations, becoming a dominant force in the online pet industry.

As we await Chewy’s full financial report for 2023 on March 20th, preliminary figures suggest impressive growth. The company is projected to announce approximately $11 billion in net sales for the year, with a significant portion, nearly three-quarters, attributed to consumable goods like pet food. This remarkable achievement underscores Chewy’s success in capturing market share from long-standing competitors within the pet food sector.

Why Chewy Dominates the Online Pet Food Market

Chewy’s ascent in the pet industry is fueled by several key factors. Firstly, the increasing trend of online shopping for pet supplies is a major tailwind. Pet owners are more and more comfortable purchasing essentials, including pet food, through digital platforms. This secular trend provides a strong foundation for companies like Chewy. Secondly, Chewy’s e-commerce platform excels in convenience, notably through its automatic shipment scheduling. This feature resonates strongly with customers, as evidenced by the fact that 75% of Chewy’s sales originate from autoship subscriptions. Finally, Chewy’s commitment to outstanding customer service distinguishes it in a competitive landscape. This focus on customer satisfaction builds loyalty and reinforces its position as a leading chewy pet food company.

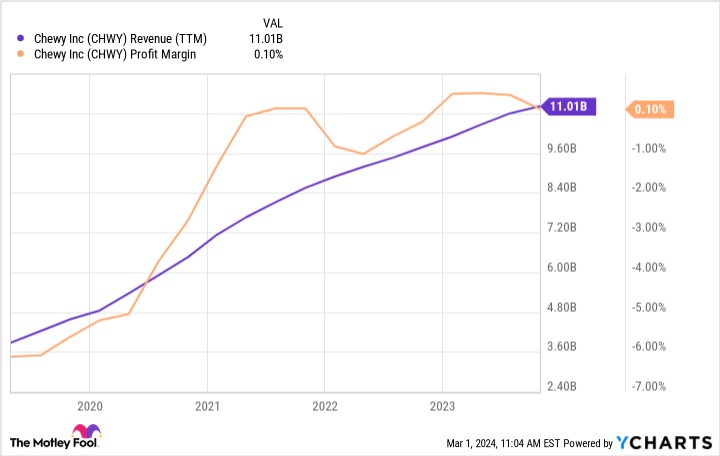

However, Chewy’s most impressive feat is its journey to profitability. The pet food industry is characterized by intense competition and typically thin profit margins. Furthermore, operating as a dedicated e-commerce platform inherently involves substantial shipping and logistical expenses. To overcome these challenges, Chewy strategically invested in automation, opening its first automated distribution center in 2020, followed by several more. This investment in automation proved to be a game-changer.

The graph clearly illustrates the significant improvement in Chewy’s profit margins coinciding with the implementation of automation. This operational efficiency is crucial for a chewy pet food company operating at scale.

Beyond Pet Food: Chewy’s Software Expansion and its Impact

Chewy has evolved into a large, profitable e-commerce platform primarily known for pet food and supplies. This success story is a significant part of the investment appeal of Chewy stock. However, many investors may be unaware of Chewy’s recent foray into an $11.5 billion market, a strategic move that could redefine the company’s future.

For years, Chewy’s leadership has discussed opportunities within pet health, primarily from a business-to-consumer perspective. The platform already offers a range of health-related services including educational content, prescription medications, telehealth consultations, and pet insurance options.

Now, Chewy is strategically pivoting towards pet health from a business-to-business angle. Their target audience is the approximately 30,000 veterinary clinics across the United States. At a recent investor day presentation in December, Chewy unveiled its operating system software for veterinary practices, named Rhapsody. This cloud-based software is designed to streamline clinic management, offering features such as appointment scheduling, client communication, expense tracking, and task management.

Complementing Rhapsody, Chewy also offers Practice Hub, another software solution. Practice Hub integrates seamlessly with Rhapsody or other existing veterinary management software, enabling vets to efficiently procure necessary products for their patients. Essentially, Practice Hub functions as an e-commerce portal for veterinary clinics, minimizing the need for extensive on-site inventory. Vets can conveniently order supplies from Chewy pet food company through their existing management systems.

This strategic shift into software provides clear advantages for Chewy. It significantly expands the company’s addressable market by tapping into enterprise clients. Moreover, it has the potential to bolster Chewy’s core retail business as veterinary practices become integrated within the Chewy ecosystem. Mita Malhotra, president of Chewy’s health division, emphasized that this initiative allows Chewy to “unlock the $11.5 billion in clinic product sales [total addressable market] that we don’t participate in today and make us even more strategic to our already existing supply relationships.”

The Future is Bright for Chewy and its Pet Food Business

When a company of Chewy’s magnitude, with $11 billion in sales, unlocks a new $11.5 billion market opportunity, it is a significant development. The growth potential from its software business could be substantial if adoption rates are strong.

This development is particularly relevant for investors today. Currently, Chewy stock is trading at a historically low valuation.

This low price-to-sales ratio suggests that the market may be underestimating Chewy’s future growth prospects or its ability to generate profits for shareholders – or possibly both. However, Chewy’s new software business has the potential to create a recurring revenue stream and further stimulate growth in its established e-commerce operations, especially within the chewy pet food company segment.

Furthermore, continued expansion of its e-commerce business can fuel the growth of Chewy’s emerging digital advertising business, a high-margin opportunity. Increased scale in its retail operations, driven by efficiencies from automation, will also contribute to improved profitability. Additionally, high-margin ventures like software and advertising can significantly enhance Chewy’s bottom line.

In conclusion, the market’s current valuation may not fully recognize the transformative potential of Chewy’s enterprise software business. If Chewy succeeds in this new venture, it could easily become a market-beating stock, driven by both its robust chewy pet food company foundation and its innovative expansion into software solutions for the veterinary industry.