Billionaire tech mogul Peter Thiel, known for his libertarian views and criticisms of high taxes, has ironically mastered the art of tax avoidance himself. While publicly decrying “confiscatory taxes” and funding anti-tax initiatives, Thiel has quietly cultivated a massive, tax-exempt fortune within a Roth Individual Retirement Account (IRA). Confidential IRS data reveals how Thiel transformed a modest Roth IRA, initially funded with less than $2,000 in 1999, into a staggering $5 billion windfall.

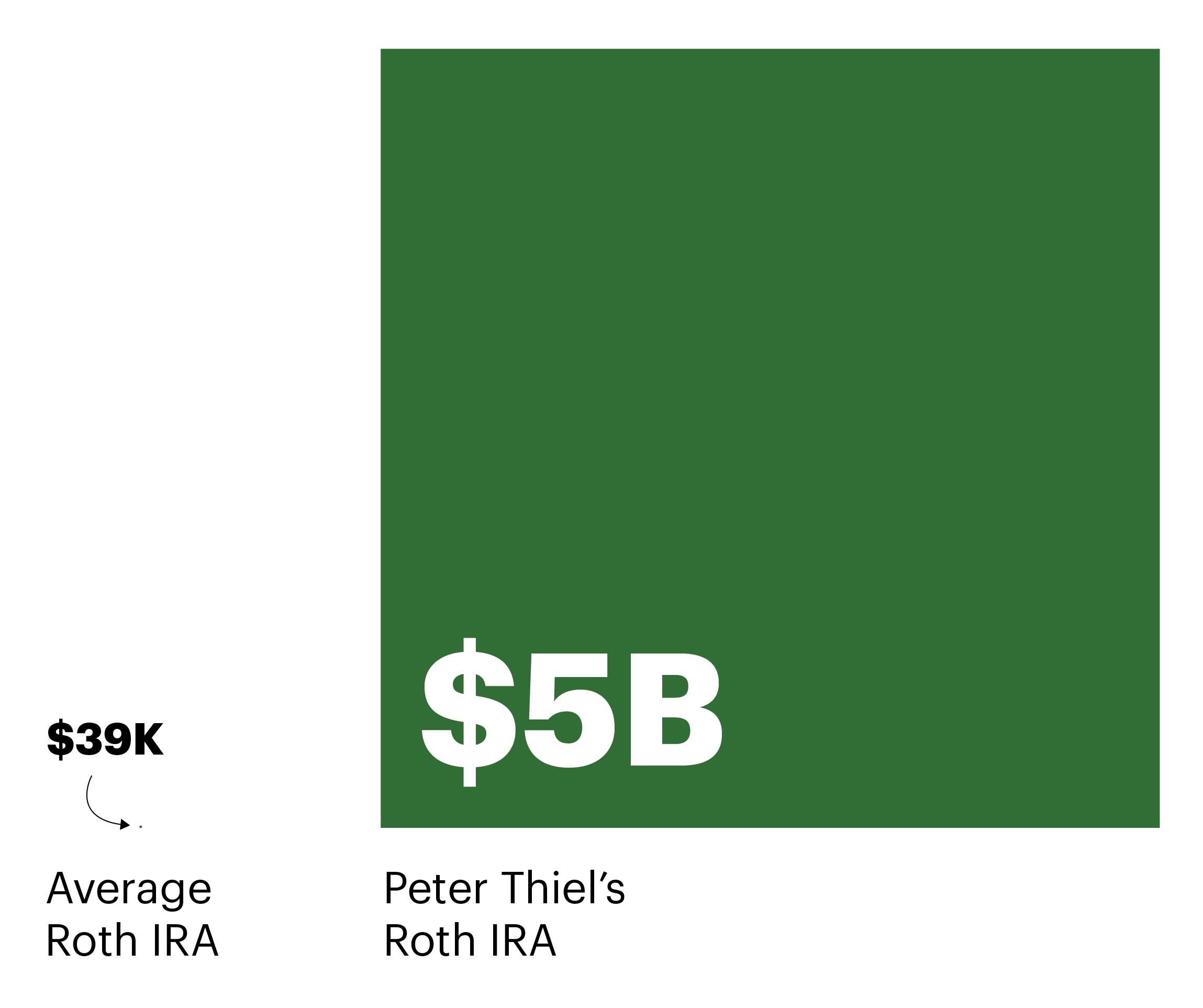

To truly grasp the scale of Thiel’s Roth IRA, consider this: the average Roth IRA in 2018 held approximately $39,108. Thiel’s Roth IRA dwarfs this figure by an astronomical margin. In fact, if every resident of Houston, Texas – a city of 2.3 million people – deposited $2,000 into a bank account, the combined sum would still fall short of Thiel’s Roth IRA holdings.

What makes this financial feat even more remarkable is that Thiel will likely never pay a single penny in taxes on this $5 billion fortune. By waiting until April 2027, just months before his 60th birthday, Thiel can withdraw the entire sum completely tax-free.

This revelation comes from a vast trove of leaked IRS tax return data obtained by ProPublica, offering an unprecedented glimpse into the financial lives of America’s wealthiest individuals. The data exposes a stark reality: while ordinary Americans diligently pay their taxes, contributing to public services and infrastructure, the ultra-rich are adeptly navigating and, in some cases, circumventing the tax system. One of the most surprising and effective tools in their arsenal is the Roth IRA, a retirement savings vehicle originally intended for middle-class Americans.

The Roth IRA: From Middle-Class Tool to Elite Tax Shelter

The Roth IRA was established in 1997, championed by the late Senator William Roth Jr. as a way for “hard-working, middle-class Americans” to save for retirement tax-free. The Clinton administration, wary of providing excessive tax breaks to the wealthy, initially limited Roth IRA access to individuals earning less than $110,000 per year (or $160,000 for couples) and capped annual contributions at $2,000.

However, even from its inception, a loophole existed, and astute entrepreneurs like Peter Thiel were quick to exploit it. The strategy was simple yet potent:

- Seed a Roth IRA with a small initial contribution, often just a few thousand dollars or less.

- Utilize the Roth IRA to purchase shares in a promising startup company at a deeply discounted price, typically fractions of a penny per share. These deals are often exclusive, unavailable to the general public.

- Hold onto these shares within the Roth IRA as the startup grows. If the company achieves significant success, the value of the shares can skyrocket exponentially.

- Benefit from tax-free growth and withdrawals. As long as the funds remain within the Roth IRA until age 59 and a half, all gains accumulate tax-free, and withdrawals in retirement are also tax-free.

- Reinvest proceeds within the Roth IRA. The tax-free gains can be used to make further investments, compounding the tax-sheltered growth.

A decade after the Roth IRA’s creation, Congress further widened the tax loophole. Legislation allowed individuals, regardless of income, to convert traditional IRAs and other retirement accounts into Roth IRAs by paying a one-time income tax on the converted amount. This “Roth conversion” effectively created a domestic tax haven, allowing the ultra-wealthy to shield vast fortunes from future taxation.

From $2,000 to $5 Billion: The Roth IRA’s Astonishing Growth

ProPublica’s investigation into mega-Roth IRAs began by analyzing tax return data of the ultra-wealthy, specifically targeting IRA accounts exceeding $20 million in value. Their analysis, combined with SEC filings, court documents, and other records, revealed a pattern of Roth IRA usage far beyond their intended purpose. These accounts were no longer simply retirement nest eggs; they had become supercharged investment vehicles, subsidized by American taxpayers.

Alongside Thiel, other prominent figures in the financial world have amassed colossal Roth IRA balances:

- Ted Weschler: A top investment manager at Berkshire Hathaway, Warren Buffett’s company, held $264.4 million in his Roth IRA in 2018.

- Randall Smith: A hedge fund manager at Alden Global Capital, known for its controversial newspaper acquisitions, had $252.6 million in his Roth IRA.

- Warren Buffett: Even the “Oracle of Omaha” himself, a vocal advocate for higher taxes on the wealthy, had $20.2 million in a Roth IRA.

- Robert Mercer: The former Renaissance Technologies hedge fund manager held $31.5 million in his Roth IRA.

While Weschler acknowledged the generous tax benefits of Roth IRAs and expressed support for reform, representatives for Buffett, Mercer, and Smith declined to comment.

The Government Accountability Office (GAO), the investigative arm of Congress, has repeatedly warned about the potential for Roth IRA abuse by the wealthiest Americans. However, simultaneous budget cuts to the IRS have severely hampered the agency’s ability to effectively audit and address these practices. In a striking example of underfunding, the IRS at one point in 2015 lacked the resources to even input critical IRA data from paper tax filings into their computer system.

Despite occasional attempts by lawmakers like Senator Ron Wyden to reform Roth IRA rules and curb their use as mega-tax shelters, these efforts have been largely unsuccessful due to political gridlock and lobbying pressure.

The Thiel Roth IRA Timeline: A Masterclass in Tax-Free Wealth Accumulation

Peter Thiel’s Roth IRA journey began in 1999 with a pivotal visit to Pensco Pension Services, a firm specializing in self-directed retirement accounts allowing for diverse investments. Tom Anderson, Pensco’s founder, recalled advising Thiel and other PayPal executives to consider Roth IRAs for their startup shares. The tax-free growth potential of a Roth IRA, especially for a high-growth venture like PayPal, was immediately apparent.

In early 1999, Thiel opened his Roth IRA and used just $1,700 to purchase 1.7 million shares of PayPal at an astonishingly low price of $0.001 per share. At the time, Thiel’s income was $73,263, placing him within the Roth IRA contribution limits. This purchase was made possible by PayPal offering founders’ shares to executives at “below fair value,” as later disclosed in SEC filings.

Tax law experts like Victor Fleischer have characterized such transactions as potentially scandalous, arguing that purchasing startup shares at deeply discounted prices within a Roth IRA is an aggressive and questionable tactic to circumvent contribution limits and maximize tax benefits.

Despite the influx of investor capital into PayPal and the company’s rapidly growing valuation, Pensco reported the value of Thiel’s Roth IRA to the IRS at the end of 1999 as a mere $1,664. Pensco founder Anderson stated that they relied on companies to self-report the value of private shares held in Roth IRAs.

The eBay acquisition of PayPal in 2002 proved to be a watershed moment. Thiel sold his PayPal shares within his Roth IRA, realizing massive tax-free gains. By the end of 2002, his Roth IRA was worth $28.5 million. Had these shares been held outside a Roth IRA, Thiel would have faced substantial capital gains taxes.

With his tax-free millions, Thiel strategically reinvested within his Roth IRA, acquiring shares in other promising startups like Palantir and Facebook at early stages. His $500,000 investment in Facebook, placed within his Roth IRA, further cemented his tax-free gains as Facebook’s valuation soared.

Despite benefiting immensely from the Roth IRA tax advantages, Thiel publicly advocated for fiscal conservatism and reduced government spending. He even criticized the tax burden on the middle class, while simultaneously leveraging a tax-advantaged account to accumulate billions.

Roth Conversions and Congressional Inaction

The 2006 legislative change allowing Roth conversions for all income levels further amplified the potential for mega-Roth IRAs. This provision, initially intended to offset revenue losses from capital gains tax cuts, inadvertently opened the floodgates for the wealthy to convert massive traditional IRAs into tax-free Roth IRAs.

While Roth conversions require paying income tax on the converted amount, for the ultra-wealthy, this one-time tax payment was a small price to pay for permanent tax exemption on future growth. Figures like Ted Weschler and Warren Buffett took advantage of Roth conversions to shelter substantial portions of their wealth.

Despite growing awareness of mega-Roth IRAs and their potential for tax avoidance, meaningful reform efforts have stalled. The IRS, underfunded and understaffed, struggles to effectively audit complex IRA transactions and challenge aggressive valuation tactics. Proposals to limit Roth IRA balances or restrict investments in non-publicly traded assets have failed to gain sufficient political traction.

Thiel’s Roth IRA Today: A $5 Billion Fortress

By 2019, Peter Thiel’s Roth IRA had reached a staggering $5 billion, spread across 96 subaccounts. His Roth IRA holdings alone surpassed Forbes’ estimated net worth for Thiel in that year. He moved his Roth IRA to Rivendell Trust, a family trust company named after the elven sanctuary in Tolkien’s “Lord of the Rings,” further emphasizing the account’s role as a protected financial fortress.

Thiel’s story highlights a critical issue within the U.S. tax system: the potential for legal tax avoidance strategies to exacerbate wealth inequality. While Roth IRAs were designed to encourage retirement savings for middle-class Americans, they have become a powerful tool for the ultra-wealthy to accumulate and shield vast fortunes from taxation. As long as loopholes remain and enforcement capacity is limited, the mega-Roth IRA phenomenon is likely to persist, further concentrating wealth at the top and shifting the tax burden onto ordinary working Americans.

The case of Peter Thiel’s Roth IRA serves as a stark reminder of the complex and often inequitable nature of the modern tax system, and the urgent need for comprehensive reform to ensure fairness and prevent the erosion of the tax base.