Navigating the complexities of pet insurance can be daunting, especially when faced with unexpected policy cancellations. At PETS.EDU.VN, we’re here to shed light on the recent reports of Nationwide cancelling pet insurance policies, offering guidance and resources to help you secure the best coverage for your beloved companions. Explore our comprehensive articles on pet healthcare and insurance options to ensure your pet’s well-being is protected. Discover essential information about pet protection plans and veterinary cost management strategies at PETS.EDU.VN.

1. Understanding the Nationwide Pet Insurance Policy Cancellations

1.1. Why is Nationwide Cancelling Pet Insurance Policies?

Nationwide has recently started sending non-renewal letters to its pet insurance policyholders across the country. While the exact reasons for these cancellations remain unclear, one former Nationwide executive suggested the company is facing profitability challenges. He stated that despite efforts to improve profitability, Nationwide Pet has struggled, leading to the drastic step of cancelling “Whole Pet With Wellness” policies. According to sources, these policies primarily protect older pets, making them more difficult to insure elsewhere.

1.2. How Many Policyholders Are Affected by the Cancellations?

The exact number of affected policyholders remains undisclosed by Nationwide. However, a former pet insurance executive estimated that at least 300,000 policyholders could be impacted. This lack of transparency highlights the importance of regulatory oversight to protect consumers. As it stands, pet insurance companies are required to report non-renewed policies and other data to regulators, but this information is not publicly available unless it becomes part of an enforcement action.

1.3. What Types of Policies Are Being Cancelled?

Nationwide appears to be primarily cancelling “Whole Pet With Wellness” policies. These policies are comprehensive, covering a wide range of veterinary expenses, including wellness care. The cancellation of these policies is particularly concerning for owners of older pets, who often require more frequent and costly veterinary care.

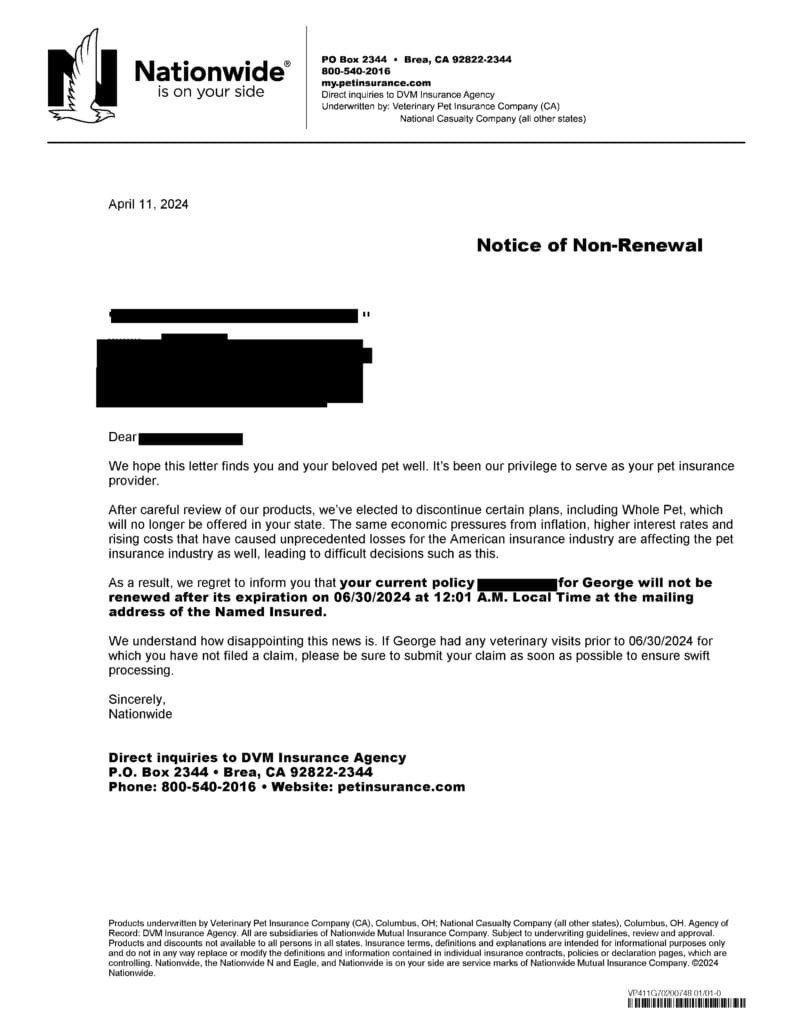

Nationwide Non-Renewal Letter

Nationwide Non-Renewal Letter

2. Expert Opinions on the Matter

2.1. What Does the NAIC Consumer Advocate Say?

Birny Birnbaum, recently retired from the National Association of Insurance Commissioners (NAIC), criticized Nationwide’s actions. Birnbaum likened the situation to the long-term care insurance playbook, where insurers close out one product and offer a new product to those less likely to file future claims. He argued that regulators should intervene, as this practice essentially constitutes post-claims underwriting. Birnbaum suggested that if higher claim costs are the issue, Nationwide should file for higher rates instead of cancelling policies. He also questioned the trustworthiness of insurers, asking why consumers should believe that Nationwide won’t repeat this behavior with new policies in the future.

2.2. Why is Trupanion Silent on the Issue?

Trupanion, Nationwide Pet’s largest competitor, has notably remained silent on the issue. Despite numerous requests for comment, Trupanion’s founder and CEO Darryl Rawlings, along with president Margi Tooth, have declined to address the situation. This silence is surprising, given Rawlings’s previous outspokenness on pet insurance regulatory matters and his alignment of Trupanion with veterinary interests.

3. What to Do If Your Nationwide Pet Insurance Policy is Cancelled

3.1. Review Your Policy Documents

Carefully review your policy documents to understand the terms and conditions of your cancellation. Look for any clauses that might provide recourse or options for appeal. Pay attention to the cancellation date and any deadlines for action.

3.2. Shop Around for a New Pet Insurance Provider

Don’t wait until your policy is officially cancelled to start looking for a new pet insurance provider. Research different companies and compare their coverage options, premiums, and deductibles. Consider factors such as the age and health of your pet, your budget, and the types of veterinary care you anticipate needing. PETS.EDU.VN offers a comprehensive guide to finding the best pet insurance plans to suit your needs.

3.3. Consider a Veterinary Savings Plan

If you’re having difficulty finding affordable pet insurance, consider a veterinary savings plan. These plans offer discounts on veterinary services at participating clinics. While they don’t provide the same level of coverage as pet insurance, they can help you manage the costs of routine care and unexpected medical expenses.

3.4. Talk to Your Veterinarian

Your veterinarian can provide valuable advice and guidance on finding the right pet insurance or savings plan for your pet. They may also be able to recommend specific insurance companies or plans that they have had positive experiences with. Additionally, your veterinarian can help you understand the potential health risks and costs associated with your pet’s breed and age.

3.5. File a Complaint with Your State Insurance Regulator

If you believe that Nationwide has acted unfairly or in violation of your policy terms, file a complaint with your state insurance regulator. This can help bring attention to the issue and potentially lead to regulatory action. Provide all relevant documentation, including your policy documents, cancellation letter, and any correspondence with Nationwide.

4. Understanding Pet Insurance and Its Importance

4.1. What is Pet Insurance?

Pet insurance is a type of insurance policy that helps cover the costs of veterinary care for your pet. It works similarly to human health insurance, with premiums, deductibles, and co-insurance. Pet insurance can help you afford unexpected veterinary bills and ensure that your pet receives the best possible care.

4.2. Why is Pet Insurance Important?

Veterinary care can be expensive, especially for unexpected illnesses or injuries. Pet insurance can help you manage these costs and avoid having to make difficult decisions about your pet’s care based on financial constraints. Additionally, pet insurance can provide peace of mind knowing that you’re prepared for any potential health issues that may arise.

4.3. What Does Pet Insurance Typically Cover?

Pet insurance policies vary in their coverage, but most typically cover:

- Accidents: Injuries resulting from accidents, such as broken bones, cuts, and swallowed objects.

- Illnesses: Treatment for illnesses, such as infections, cancer, and diabetes.

- Surgery: Costs associated with surgical procedures.

- Hospitalization: Expenses for overnight stays at the veterinary hospital.

- Diagnostic Tests: Costs for tests such as X-rays, bloodwork, and MRIs.

- Prescription Medications: Coverage for prescription drugs.

4.4. What Doesn’t Pet Insurance Typically Cover?

Most pet insurance policies don’t cover:

- Pre-existing Conditions: Conditions that your pet had before you enrolled in the policy.

- Routine or Preventative Care: Regular check-ups, vaccinations, and flea/tick prevention (although some policies offer add-ons for wellness care).

- Cosmetic Procedures: Procedures such as tail docking and ear cropping.

- Breeding or Pregnancy-Related Costs: Costs associated with breeding, pregnancy, and whelping.

4.5. Types of Pet Insurance Policies

There are several types of pet insurance policies available, each with its own coverage and cost:

- Accident-Only: Covers only accidents and injuries, not illnesses. This is the most basic and affordable type of policy.

- Accident and Illness: Covers both accidents and illnesses, providing more comprehensive coverage.

- Comprehensive: Covers accidents, illnesses, and sometimes wellness care, offering the most extensive protection.

- Wellness Plans: These are not technically insurance but rather add-ons or separate plans that cover routine care such as vaccinations and check-ups.

5. How to Choose the Right Pet Insurance Policy

5.1. Consider Your Pet’s Breed and Age

Certain breeds are predisposed to specific health conditions, which can increase the cost of insurance. Older pets are also more likely to develop health problems, making insurance more expensive. Consider these factors when choosing a policy.

5.2. Evaluate Your Budget

Pet insurance premiums can vary widely, so it’s important to find a policy that fits your budget. Keep in mind that lower premiums often come with higher deductibles and co-insurance.

5.3. Compare Coverage Options

Carefully compare the coverage options offered by different policies. Consider what types of veterinary care you anticipate needing and choose a policy that provides adequate coverage for those needs.

5.4. Read Reviews and Get Recommendations

Read reviews from other pet owners and ask your veterinarian for recommendations. This can help you find a reputable insurance company with good customer service and fair claims processing.

5.5. Understand the Fine Print

Before enrolling in a pet insurance policy, carefully read the fine print to understand the terms and conditions of coverage. Pay attention to exclusions, limitations, and waiting periods.

6. Alternative Options to Pet Insurance

6.1. Veterinary Savings Accounts

A veterinary savings account is a dedicated savings account specifically for pet healthcare expenses. You can set aside a certain amount of money each month to cover routine care, unexpected vet bills, and other pet-related costs.

6.2. CareCredit

CareCredit is a credit card specifically for healthcare expenses, including veterinary care. It offers financing options and payment plans to help you manage the cost of veterinary bills.

6.3. Negotiate with Your Veterinarian

Don’t be afraid to negotiate with your veterinarian about the cost of treatment. Many veterinarians are willing to work with pet owners to find affordable solutions, such as offering discounts or payment plans.

6.4. Consider Pet-Specific Charities

Several charities provide financial assistance to pet owners who cannot afford veterinary care. Research these organizations and see if you qualify for assistance.

6.5. Preventative Care

Investing in preventative care, such as regular check-ups, vaccinations, and parasite prevention, can help prevent costly health problems down the road. Talk to your veterinarian about the best preventative care plan for your pet.

7. The Future of Pet Insurance

7.1. Increased Regulatory Oversight

As the pet insurance industry grows, there is increasing pressure for greater regulatory oversight to protect consumers. This could include requirements for transparency, standardized policy terms, and fair claims processing.

7.2. Technological Advancements

Technological advancements are likely to play a role in the future of pet insurance. This could include the use of wearable technology to monitor pets’ health and provide early warnings of potential problems, as well as the use of artificial intelligence to streamline claims processing and personalize insurance plans.

7.3. Growing Demand for Wellness Care

There is a growing demand for pet insurance policies that cover wellness care, such as routine check-ups, vaccinations, and dental cleanings. Insurance companies are likely to respond to this demand by offering more comprehensive policies or add-ons for wellness care.

8. Protecting Your Pet’s Health and Well-being

8.1. Regular Veterinary Check-ups

Regular veterinary check-ups are essential for maintaining your pet’s health and well-being. Your veterinarian can detect potential health problems early and recommend appropriate treatment.

8.2. Proper Nutrition

Proper nutrition is crucial for your pet’s health. Feed your pet a high-quality diet that is appropriate for their age, breed, and activity level. Talk to your veterinarian about the best food options for your pet.

8.3. Exercise and Mental Stimulation

Exercise and mental stimulation are important for your pet’s physical and mental health. Provide your pet with plenty of opportunities for exercise, play, and social interaction.

8.4. Vaccinations and Parasite Prevention

Vaccinations and parasite prevention are essential for protecting your pet from infectious diseases and parasites. Follow your veterinarian’s recommendations for vaccinations and parasite prevention.

8.5. Create a Safe and Comfortable Environment

Create a safe and comfortable environment for your pet. This includes providing a comfortable bed, fresh water, and a safe place to play and relax.

9. How PETS.EDU.VN Can Help

9.1. Comprehensive Information and Resources

PETS.EDU.VN offers a wealth of information and resources on pet health, insurance, and care. Our articles and guides cover a wide range of topics, from choosing the right pet insurance policy to managing common health problems.

9.2. Expert Advice and Guidance

Our team of experts is dedicated to providing accurate and reliable advice to pet owners. We consult with veterinarians, insurance professionals, and other experts to ensure that our information is up-to-date and trustworthy.

9.3. Community Support

PETS.EDU.VN offers a community forum where pet owners can connect with each other, share experiences, and ask questions. Our community is a valuable resource for finding support and advice from other pet owners.

9.4. Service Recommendations

We provide recommendations for trusted veterinary clinics, pet insurance providers, and other pet-related services. Our recommendations are based on thorough research and user reviews to ensure that you receive the best possible care for your pet.

9.5. Latest Updates and News

We keep you informed about the latest updates and news in the pet industry, including changes in pet insurance policies, new treatments for common health problems, and important safety recalls.

10. Frequently Asked Questions (FAQ) About Pet Insurance Cancellations

10.1. Can a pet insurance company cancel my policy?

Yes, a pet insurance company can cancel your policy under certain circumstances, such as non-payment of premiums or material misrepresentation on your application. Recent reports indicate Nationwide is cancelling policies due to profitability issues.

10.2. What are my rights if my pet insurance policy is cancelled?

If your pet insurance policy is cancelled, you have the right to receive written notice of the cancellation, along with the reason for the cancellation. You may also have the right to appeal the cancellation or request a refund of any unearned premiums.

10.3. How can I find a new pet insurance policy after a cancellation?

After a cancellation, start by researching different pet insurance companies and comparing their coverage options, premiums, and deductibles. Consider your pet’s breed, age, and health history when choosing a new policy. PETS.EDU.VN can help you find the best pet insurance plans.

10.4. Will a cancellation affect my ability to get pet insurance in the future?

A cancellation may make it more difficult to get pet insurance in the future, especially if the cancellation was due to fraud or misrepresentation. Be honest and transparent when applying for new coverage.

10.5. Can I switch pet insurance companies at any time?

Yes, you can switch pet insurance companies at any time. However, be aware of any waiting periods or pre-existing condition exclusions that may apply to your new policy.

10.6. What is a pre-existing condition?

A pre-existing condition is any illness or injury that your pet had before you enrolled in a pet insurance policy. Most pet insurance policies do not cover pre-existing conditions.

10.7. What is a waiting period?

A waiting period is the time between when you enroll in a pet insurance policy and when coverage begins. Most pet insurance policies have waiting periods for certain conditions or treatments.

10.8. How much does pet insurance cost?

The cost of pet insurance varies depending on factors such as your pet’s breed, age, health history, and the coverage options you choose. Premiums can range from $20 to $100 or more per month.

10.9. Is pet insurance worth it?

Whether pet insurance is worth it depends on your individual circumstances and risk tolerance. If you are concerned about the potential costs of veterinary care, pet insurance can provide peace of mind and financial protection.

10.10. What are the best pet insurance companies?

The best pet insurance companies depend on your individual needs and preferences. Some popular and reputable companies include Trupanion, Embrace, Pets Best, and Healthy Paws. PETS.EDU.VN offers detailed reviews and comparisons of these and other pet insurance companies.

Navigating the world of pet insurance can be challenging, but PETS.EDU.VN is here to help. Stay informed, protect your pet, and ensure they receive the best care possible. For more information and guidance, visit pets.edu.vn or contact us at 789 Paw Lane, Petville, CA 91234, United States or Whatsapp: +1 555-987-6543. We’re dedicated to providing you with the knowledge and resources you need to make informed decisions about your pet’s health and well-being. Explore our range of articles and services designed to support pet owners every step of the way.